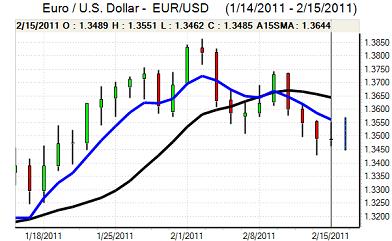

EUR/USD

The Euro tested technical levels during Tuesday, but failed to make a decisive break in either direction and consolidated in the 1.3530 area as support below 1.3480, helped by the suspicion of further Asian central bank buying.

The Euro-zone data was slightly weaker than expected with fourth-quarter GDP estimated at 0.3% compared with expectations of 0.4% and there was a further sharp contraction in the Greek economy which will remind markets that peripheral economies remain trapped within recession conditions. The German ZEW business confidence survey edged higher to 15.7 for February from 15.4, but this was weaker than expected.

There was no further progress surrounding strengthening the Euro-zone crisis mechanisms at Tuesday’s ECOFIN meeting and there were further fears that Portugal will be left exposed to renewed funding pressures and require a bailout as benchmark yields remained above the 7.00% level. There was some relief as a restructuring agreement for WestLB was agreed just ahead of the deadline.

The US economic release were also slightly below expectations as retail sales rose a headline 0.3% for January with the same underlying monthly increase. Persistent vulnerability in the housing sector was illustrated by the NAHB housing index remaining at 16, substantially below the long-term equilibrium level of 50, but the New York manufacturing PMI index did strengthen to 15.4 from 11.9. The dollar did secure some support from a narrowing of the yield gap between Treasuries and German bunds with the Euro again stalling close to 1.3550.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

The dollar found support close to 83.20 against the yen on Tuesday and advanced further in New York with an 8-week high near 83.90 before correcting slightly lower. Yield spreads remained an important factor with the dollar’s advantage over the Japanese instruments rising to an 8-week high on two-year bonds which boosted demand for the US currency.

Global equity markets remained in a buoyant mood which helped underpin risk appetite and also boosted demand for carry trades funded through the yen, although volatility will remain a clear risk.

Domestically, there were indications that the Finance Ministry is concerned over the risk of further credit-rating downgrades and underlying sentiment towards the yen is liable to remain weak.

Sterling

The latest UK consumer inflation data was broadly in line with expectations as the headline rate rose to 4.0% from 3.7% and there was a core rate of 3.0%. There had been some speculation over an even higher rate and Sterling retreated to near 1.60 against the dollar following the data release.

Bank of England Governor King was forced to issue a letter of explanation over the high inflation rate and he pointed to further upside inflation risks in the short term. He also stated that there was a very high degree of uncertainty over the outlook and that there were important splits within the MPC. The comments overall increased speculation that the central bank would move to increase interest rates during the second quarter and Sterling advanced following the letter’s release with a high near 1.6180 against the US dollar.

The central bank inflation report on Wednesday is likely to confirm expectations for higher rates, but there will also still be fears that the economy will be undermined by higher rates. The key question is also why the bank has not increased rates already given the inflation outlook. High volatility is likely to remain a key market feature with Sterling close to 1.6150 in Asia on Wednesday as the Euro remained trapped below 0.84.

Swiss franc

The dollar was unable to make a fresh attack on resistance levels above 0.9750 on Tuesday and dipped sharply during the US session with lows near 0.9660. There was a further slight erosion during Asian trading on Wednesday as the franc also secured some net advance against the Euro.

The franc’s performance over the past 24 hours suggests that risk appetite may have peaked and the currency has also drawn some support from fresh doubts over the Euro area’s to strengthen defences against market attacks. Uncertainty surrounding the Euro-zone will continue to limit selling pressure on the franc.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

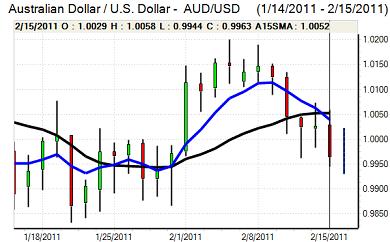

Australian dollar

The Australian dollar was blocked close to 1.0050 during Tuesday and weakened steadily during the US session. There was a further decline to lows just below 0.9950 in Asia on Wednesday before a recovery to near parity. Given that risk conditions were firm, the currency’s inability to make headway could be important.

There was a decline in commodity prices which had some negative impact on the currency. There was some initial relief following the Chinese inflation data, but there were also fears that underlying credit and inflation pressures were still building both in China and regionally.