EUR/USD

The Euro found support below 1.3650 against the dollar in Europe on Friday and extended the recovery to test resistance above 1.37 ahead of the US open.

Euro-zone developments remained extremely important and there were further expectations that Ireland was very close to securing a support package for the banking sector. Discussions continued throughout the day with expectations of an agreement over the weekend with Ireland also due to announce further measures to curb the budget deficit.

An easing of immediate fears surrounding Ireland will help underpin Euro sentiment to some extent, but there will still be a high degree of unease over the medium-term outlook, especially as there is still an important contagion risk. So far, there does not appear to have been heavy investment outflows from the Euro area which should maintain the potential for solid buying support on dips.

There were no major US economic data releases during Friday. Fed Chairman Bernanke defended the Fed’s economic policies and his comments do not suggest that the central bank is looking to move back from the quantitative easing process and this will tend to limit dollar support.

Risk appetite was initially weaker following the Chinese move to increase reserve requirements and the Euro also hit tough resistance above 1.37 which helped trigger a move back towards 1.3650 later in the US session. There will be the risk of choppy trading over the forthcoming week with liquidity curbed by the US Thanksgiving holiday. Media reports suggested that a deal worth at least EUR70bn would be announced and the Euro pushed back above 1.37 in Asia on Monday.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

The dollar was blocked in the 83.80 region against the yen during Friday, but still found solid buying support on dips towards the 83.20 area as the underlying technical outlook remained more encouraging for the US currency.

The yen advanced following the Chinese announcement that reserve requirements for the major banks would be increased again at the end of November, although the impact was offset to some extent by the fact that there was less speculation over a near-term increase in interest rates.

Risk conditions also held relatively steady with US equity markets on solid ground and the dollar consolidated in the 83.50 area with the Japanese currency slightly weaker on the crosses.

Sterling

Sterling tested resistance above 1.6060 against the US dollar on Friday, but was unable to break through and weakened to re-test support below the 1.60 level during the US session before finding support near 1.5950.

The UK currency lost support against the Euro as markets continued to anticipate an Irish support package with the Euro advancing to the 0.8550 area. Selling pressure on Sterling should be contained to some extent by the fact that any deal for Ireland will also lessen market fears that there would be a contagion effect of bad loans on the UK banking sector.

Bank of England MPC member Tucker stated that he wanted to be extremely vigilant over inflation expectations and this should boost market expectations that the central bank will resist further near-term quantitative easing. Underlying confidence is still liable to be fragile and frequent shifts in expectations will remain an important market feature with Sterling moving slightly higher against the dollar on Monday.

Swiss franc

The franc remained generally on the defensive against the Euro during Friday, but did find some support weaker than 1.3620. The franc also secured support close to parity against the dollar with the US currency weakening back to the 0.9920 area later in the US session.

Immediate defensive demand for the franc remained lower as markets remained confident that a support package for the Irish banking sector would be agreed. It may still prove more difficult for the Euro to gain sustained relief given underlying fears surrounding the region.

Confidence in the Swiss economy is likely to remain slightly weaker in the short term following subdued growth indicators which will tend to curb franc demand.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Australian dollar

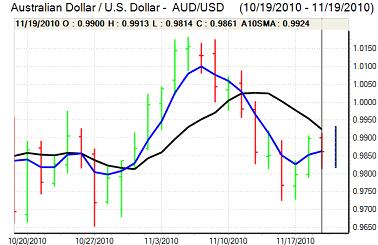

The Australian dollar hit resistance above 0.99 against the US currency on Friday and had a weaker tone for the session, although it recovered from its worst levels below 0.9850.

The Australian dollar was undermined by the increase in reserve requirements for Chinese banks as it maintained fears that the Chinese economy would have to be cooled further which would dampen regional demand.

There were also doubts surrounding the domestic economy and fears that consumer spending and growth could slow more substantially than expected over the next few months.