EUR/USD

The Euro found support near 1.3650 against the dollar on Tuesday and consolidated near 1.37 ahead of the US open. There were sharp Euro gains in New York trading with a push to highs above 1.38.

Euro-zone developments remained the principal trigger for currency moves with the Euro gaining support from speculation that there would be a support package for Greece. The European Commission suggested that financial assistance could be made available in return for austerity measures by the Greek government. The Euro may gain some further near-term support if tensions continue to ease, but the underlying situation is liable to be precarious given the underlying vulnerabilities.

There will also be important longer-tern risks associated with any support measures that lack credibility as there would be fears of moral hazard and the Euro could then be subjected to renewed selling pressure relatively quickly.

There were no major US developments during the day and heavy snow will also cause some disruption. Fed Chairman Bernanke’s testimony to the House of Representatives has been cancelled, although his written comments will still be released. The dollar will gain some degree of support if there is evidence of a tougher than expected stance on an exit strategy by Bernanke, although the more cautious tone appears likely which would tend to limit currency support.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate* 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

There was no significant test of dollar support levels near 89 against the yen on Tuesday as yen buying faded. Indeed, there was some more general yen selling later in the US session as risk appetite improved following expectations of a support package for Greece.

The Euro recovered ground against the yen and this also pushed the dollar towards the 90 level against the Japanese currency.

Domestically, the latest machinery goods orders data was stronger than expected with an increase of 20.1% for December which was sharply higher than expected. The data series has been extremely volatile over the past few months, but may offer some degree of support for the yen on hopes of an improvement in the industrial sector and the dollar held just below 90 in Asian trading on Wednesday before edging lower after weaker than expected Chinese trade data.

Sterling

Sterling came under renewed selling pressure during Tuesday with a further test of support near 1.5550 against the US dollar.

The UK trade deficit was wider than expected with an 11-month high shortfall of GBP7.3bn for December which will tend to increase fears over the economic outlook. There was also a warning from ratings agency Fitch that the UK was the most vulnerable of the AAA-rated economies to a credit-rating downgrade. Sterling recovered to around 1.57 against the dollar later in the US session, primarily due to the impact of general dollar weakness.

The Bank of England inflation report will be extremely important for Sterling later in the day and is liable to trigger further Sterling volatility. The currency could gain some support on higher than expected inflation forecasts or a more upbeat survey of the economy from Bank Governor King, although he may be more cautious over the economic outlook which would tend to erode currency support.

Swiss franc

The dollar was unable to make any further headway on Tuesday and dipped to lows below 1.0650 against the Swiss currency with wider losses for the dollar a key factor. The Euro found some support near the 1.4650 level against the franc, but was unable to break back above 1.47. National Bank member Jordan warned that there would be action to prevent excessive franc appreciation.

The Swiss franc will tend to lose some defensive support if there is a sustained improvement in confidence surrounding the Euro-zone budget outlooks, although overall selling pressure on the currency is liable to be measured given the longer-term pressures. Similarly, any Swiss selling on an improvement in risk appetite is liable to be measured given underlying caution.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate* 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

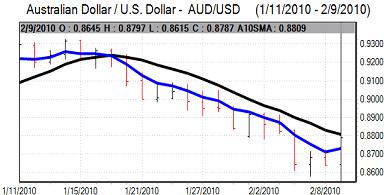

Australian dollar

The Australian dollar found support below the 0.8650 level against the US dollar on Tuesday and rallied strongly to a high near 0.88 on Wednesday. The US currency lost ground which was a positive influence while risk appetite also improved which helped underpin sentiment.

There will still be an underlying mood of caution and expectations of further Chinese policy action to curb demand which will tend to limit support for the Australian currency. There was also a decline in consumer confidence according to the latest survey which will tend to curb support.