EUR/USD

The Euro was trapped within narrower ranges during Tuesday with a slightly firmer net tone as there was no further test of support in the 1.3360 area against the dollar. The economic data had some positive Euro impact as German factory orders rose strongly for October.

Euro-zone leaders continued to debate plans ahead of Friday’s Summit meeting and there were suggestions of increased financing which would be achieved by keeping the EFSF in tandem with the new ESM which is also aimed to be launched in mid 2012 compared with 2013 previously. There was still an important degree of scepticism surrounding the plans, especially given difficulties in leveraging the EFSF, with significant political opposition also likely. There were also important underlying stresses as Treaty changes would prove highly controversial, especially within the Northern countries.

There were further underlying stresses within the banking sector as Libor rates increased again and there were fresh fears surrounding a lack of collateral and a growing reluctance to accept counter-party risk which is causing serious stresses within the European banking sector.

There was further speculation that the ECB would cut interest rates again this month and there were also expectations that the bank would be willing to engage in more aggressive bond purchases and monetary easing once a political deal was in place. For now, the bank may confine itself to more technical measures such as longer repo operations to ease liquidity stresses.

Following Standard & Poor’s warning over European credit ratings, there was also a warning that the AAA EFSF rating could be at risk if there were any downgrades to ratings for individual Euro-zone countries. There were no major US developments during the day and the Euro consolidated close to 1.34 on Wednesday.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate* 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

The dollar was trapped within narrow ranges during Tuesday with support close to the 77.60 area while there was no attack on resistance levels towards 78.0. The Euro was also broadly resilient against the yen during the day. Further strains within the global banking sector would tend to support net-creditor countries such as Japan.

There was evidence of solid yen buying during the Asian session on Friday and the Japanese currency was also still generally firm even though risk appetite was generally slightly stronger. There was still a high degree of uncertainty surrounding the Euro-zone outlook as tensions continued to increase ahead of the key Summit on Friday.

Sterling

Sterling hit resistance just above 1.5650 against the US dollar on Tuesday and dipped to lows near 1.5560 before finding some degree of support and consolidating close to 1.56.

The economic data provided no significant support with the Halifax Bank reporting a decline in house prices of 0.9% for November, although the underlying trend was broadly stable. There was also a 2.0% figure for the BRC shop-price index which was the lowest figure for six months.

The Bank of England announced a new precautionary liquidity operation which would be used in the event of credit conditions deteriorating further, although the bank was keen to emphasis that there were no liquidity difficulties at present. There were, however, further concerns over the UK outlook and Sterling, especially if there is any reduction in defensive support for the currency.

Swiss franc

The franc maintained a weaker tone during Tuesday with the dollar spiking to a high near 0.93 before retreating slightly. The Euro also tested resistance above 1.24 against the Swiss currency and held above this level during the day.

The latest consumer prices data was weaker than expected with a 0.2% decline for November compared with expectations of a 0.1% increase. The data increased market speculation over deflation within the economy and also increased expectations that the National Bank would look to push the franc even weaker in order to counter the deflation threat.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate* 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

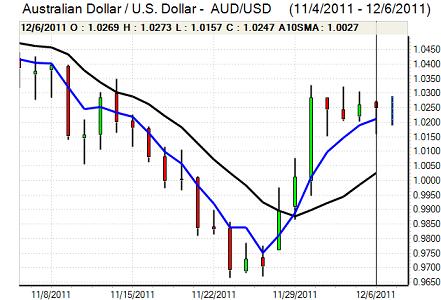

Australian dollar

The Australian dollar found support below 1.02 against the US currency on Tuesday and rallied back towards the 1.0280 area with a steady advance during the European and US sessions. There was a more resilient tone on the crosses and there was solid buying against the Euro which provided support.

The latest quarterly GDP data was in line with expectations with a 1.0% increase, but there was a stronger than expected annual reading of 2.5% which helped underpin sentiment towards the domestic economy. There was still an underlying element of caution, especially given doubts surrounding the Asian growth outlook.