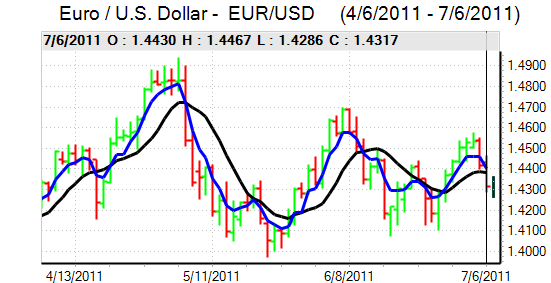

EUR/USD

The Euro came under further selling pressure during Wednesday as Euro-zone sovereign-debt fears increased again following Portugal’s rating downgrade by Moody’s. There was a further widening of yield spreads with Portugal’s benchmark 10-year benchmark yields rising to over 10% above German bonds as there was forced selling from institutions following the downgrade to junk status.

Following talks surrounding the Greek private-sector debt roll-over plans, IIF head Dallara stated that any solution to Greece’s problems could involve a temporary default and there was also evidence that roll-over participation would be limited as many institutions had already sold their bonds. More positively, Moody’s stated that it would differentiate between peripheral countries which could spare Ireland from immediate action. There were still fears of a widening contagion effect with rumours that Italy could be downgraded and there was unease surrounding the Spanish banking sector.

The ECB will be an extremely important focus on Thursday with widespread expectations that the bank will sanction a further increase in benchmark rates to 1.50% from 1.25%. The hints on future policy will be watched extremely closely and a more dovish tone would tend to put the Euro under fresh selling pressure. Trichet will also make important comments on debt restructuring and bonds.

The US ISM index for the services sector was weaker than expected with a decline to 53.3 for June from 54.6 the previous month, reinforcing expectations of slow growth within the US economy. There was a sharp deterioration in orders and prices for the month while the employment index held steady. Overall, the report reinforced expectations of subdued growth. The dollar did gain some defensive support from a deterioration in risk appetite and the Euro dipped to lows near 1.4280 before rallying back to the 1.4335 area in a technical recovery.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

The dollar was again blocked close to 81.10 against the yen during Wednesday and retreated to lows around 80.75, but was able to resist further losses.

The yen gained support from a deterioration in risk appetite as Euro-zone tensions intensified and there were also brief gains following the Chinese decision to raise interest rates. The Japanese currency advanced against the Euro, but found it difficult to gain strong support.

There will be further speculation over capital repatriation from Europe as Euro-zone fears which should help support the Japanese currency. Domestically, the 3.0% increase in machinery orders for May was in line with market expectations and the dollar nudged higher in Asia on Thursday.

Sterling

Sterling was unable to make any impression on the dollar during Wednesday and retreated sharply to lows near 1.5950 as the US currency secured wider gains. Although Sterling did advance to 0.8950 against the Euro, the general tone was defensive. The currency was unsettled to some extent by a wider deterioration in risk appetite, especially with doubts surrounding the UK banking sector.

Domestically, Sterling was unable to gain support from a 1.2% gain in the Halifax house-price index for June as underlying confidence in the economy remained weak.

The Bank of England will announce its latest interest rate decision on Thursday amid strong expectations that rates will be left on hold at 0.50%. There has been some speculation that the bank could announce additional quantitative easing and there will be some Sterling relief if there is no change while any move to increase rates would trigger a Sterling spike stronger.

The UK currency remained on the defensive in Asia on Thursday with a further probe of support towards 1.5950 against the dollar.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

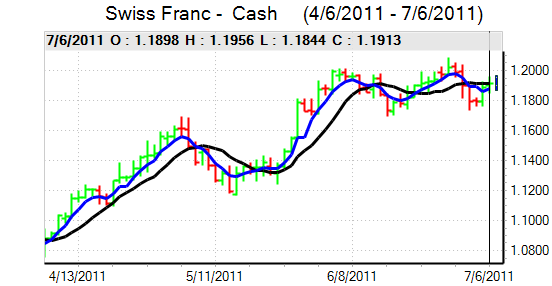

Swiss franc

The franc continued to gain strongly against the Euro on Wednesday with the single currency testing support below 1.20 as confidence in the Euro-zone deteriorated again. In an environment of general franc strength, the dollar was unable to make headway against the Swiss currency and tested support close to 0.8380. There will be further defensive inflows into the franc if Euro-zone fears intensify or the ECB takes a dovish tone at Thursday’s council meeting.

The government warned that the franc was over-valued, but it also ruled out the use of capital controls or negative interest rates to stem capital inflows. There was still some speculation that the National Bank could introduce quantitative easing which curbed franc demand to some extent.

Australian dollar

The Australian dollar found support on dips to below 1.0680 against the US currency during Wednesday even with a spike lower following the Chinese interest rate decision and the currency was broadly resilient even though risk appetite was generally weaker.

Domestically, the latest labour-market data was stronger than expected with a 23,400 increase in employment for June compared with expectations of a 15,000 gain and there was also relief that there was a gain in full-time employment. Commodity prices were generally resilient which underpinned the currency, but the housing-related data remained weak with a further retreat in the construction PMI index to below 36 in the latest monthly data.