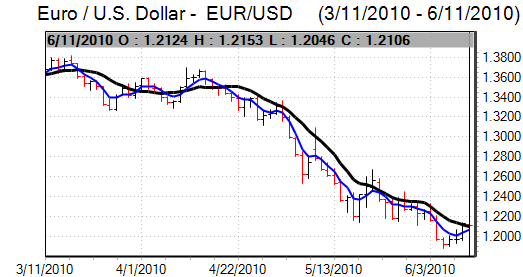

EUR/USD

The Euro edged weaker in early Europe on Monday on some media reports that Germany was preparing a strategy for allowing orderly Euro-zone member defaults. Technical considerations were also still important with the Euro vulnerable to selling pressure after the failure to break above longer-term resistance levels late last week.

Euro-zone structural doubts remained a focus during the day as uncertainty over the bank stress tests persisted. There were some fears that around 15% of banks could be deemed to have failed the tests and this had some negative impact on the Euro. A weak reading for the German ZEW data would revive unease over the growth outlook which would also tend to unsettle the Euro.

There was uncertainty over a series of bond-market auctions due to take place this week. A trend for successful sales would tend to provide some degree of relief for the Euro.

There was some uncertainty over the US corporate earnings due this week which curbed risk appetite to some extent. There were no major US data releases during the day which allowed risk considerations to remain important. The Euro retreated to lows near 1.2550 in early New York trading before a recovery to 1.2590 later in the US session.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

Japan’s coalition government lost its majority in the latest Upper-House elections as it won only 44 of the 121 seats contested. Following the result, there were renewed fears that economic reform plans would lose momentum.

Markets remain sensitive to Japan’s government debt profile and there were increased doubts whether there would be decisive measures to cut the deficit and this put the yen under some selling pressure in Asian trading on Monday. Standard & Poor’s also warned that it was uneasy over Japan’s credit rating which unsettled sentiment.

There were also doubts whether the government would be able to respond to any fresh global economic difficulties. The yen weakened to lows near 89.15 against the dollar before consolidating close to the 89 level. The US currency edged lower to the 88.50 area during the session as there was further caution surrounding earnings reports.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

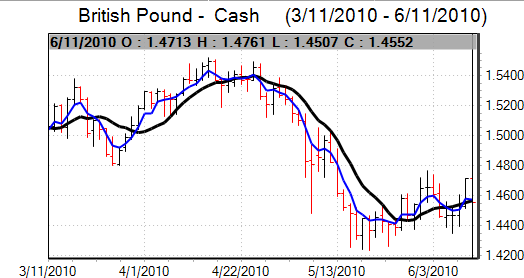

Sterling

Sterling was unable to regain the 1.51 level against the dollar in early Europe on Monday and drifted lower ahead of the UK data.

First-quarter GDP was un-revised at 0.3% according to the final release. Within the data, there was a downward revision to private-sector growth and exports which was offset by higher estimates of government spending. These revisions will increase fears that the economy will stall over the next few months.

MPC member Posen warned that there was a risk of a slip back into recession which dampened sentiment to some extent. The inflation data will be watched closely on Tuesday and a higher than expected figure could provide some degree of support.

Standard& Poor’s stated that the UK AAA credit rating was safe for now, but the outlook remained negative. In particular, the agency was concerned that forecasts were too optimistic while weaker than expected growth would cause further stresses within the budget. The current-account data was also weaker than expected which will raise some longer-term valuation doubts.

Sterling retreated to lows just below 1.4950 against the dollar before rallying back to above 1.50 as the UK currency also corrected from six-week lows near 0.8420 against the Euro.

Swiss franc

The dollar found support below 1.0550 against the dollar and rallied to a high just below 1.0680 during the European session. It was unable to sustain the advance and consolidated around 1.06 later in US trading. The Euro was unable to sustain a move above the 1.34 level and weakened back to the 1.3350 area in New York.

There were further uncertainties surrounding the Euro-zone debt outlook which curbed Euro support and provided further defensive support for the Swiss currency.

Australian dollar

After initially holding steady, the Australian dollar weakened in Asian trading on Monday with selling increasing after a break of 0.8750. The US currency was able to secure some wider respite and there was some degree of profit taking after recent gains.

Commodity prices were weaker during the day which unsettled the Australian currency to some extent, but the Australian dollar was able to resist a further test of support close to the 0.87 level as there was still underlying buying support on dips.