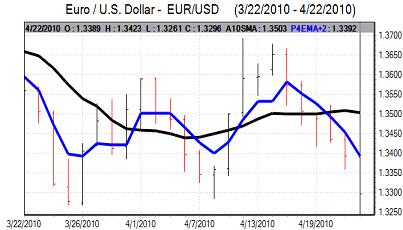

EUR/USD

The Euro was unable to push above resistance in the 1.34 area against the dollar in early Europe on Tuesday and moved steadily weaker in the European session.

Euro-zone structural fears continued to dominate market sentiment during the session with favourable German consumer confidence data having no impact. Initially, there were negative comments from the Greek central bank governor who warned that GDP was likely to decline by at least 2% in 2010.

There was a further sharp market deterioration in confidence in New York trading following credit-rating cuts by Standard & Poor’s. Greece’s rating was cut by two notches to BB+ from BBB- which put the long-term rating in the junk category. In addition, the Portuguese rating was cut to A- from A+. The action on Portugal increased fears over regional contagion and pushed the Euro sharply weaker with fears that Spanish markets could also come under pressure.

The US consumer confidence data was stronger than expected with an increase to 57.9 for April from a revised 52.3 the previous month. The latest Case-Shiller house-price index recorded an annual increase of 0.6%, the first increase for three years, although it was slightly below consensus forecasts.

The data overall should sustain confidence in the economy and help underpin the dollar, especially if there is a subtle shift in Fed rhetoric following Wednesday’s FOMC meeting.

European developments dominated during the US session and there was a decline to 1.32 later in the US session. As this support level broke, stop-loss selling triggered further losses to 1.3155.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

After holding firm on Monday, risk appetite was generally weaker in Asian trading on Tuesday. The Chinese equity market was significantly weaker as the authorities continued to warn over property-sector lending and this had a negative impact on wider risk appetite. There was also evidence that institutional Euro buying faded as the currency approached 126 against the Japanese currency.

A slightly weaker Australian dollar also curbed interest in selling the Japanese currency. The dollar weakened to the 93.75 area against the yen before edging back towards the 94 area as ranges were still relatively narrow.

The yen gained further support in US trading on Tuesday with the dollar weakening to the 92.80 level before consolidation near 93.10. The Euro weakened sharply to lows near 122.50 against the yen.

Sterling

The UK currency was unable to make any impression on resistance close to 1.55 against the dollar in Europe on Tuesday and suffered sharp losses for the day as a whole. General US strength against European currencies was an important factor, but there was also some independent weakness. A general deterioration in risk appetite was a negative factor for Sterling, especially in US trading as equity markets dipped sharply.

There were also still important underlying fears surrounding the government-debt situation, especially with opinion polls for the May 6 election still pointing to an indecisive outcome. There were also comments from economic institutes that substantially more government spending cuts needed to be announced.

The credit-rating downgrades within Europe will also tend to intensify medium-term fears over the UK rating position. The economic data did not have a major impact with the CBI retail sales index steady at 13 for April. Sterling fell sharply to lows around 1.5235 late in the US session.

Swiss franc

The dollar found support close to 1.07 against the franc on Tuesday and secured robust gains during the day with a peak near 1.0880 as European currencies came under heavy selling pressure. The Euro drifted weaker against the Swiss currency, although it held above the 1.4320 level where there has been strong evidence of National Bank intervention over the past month.

The credit-rating downgrades for Greece and Portugal will tend to maintain a defensive flow of funds into the Swiss currency on a widespread lack of confidence in Euro instruments.

The latest UBS consumption index was also firm with a significant advance for March which will also maintain optimism over the Swiss economy.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

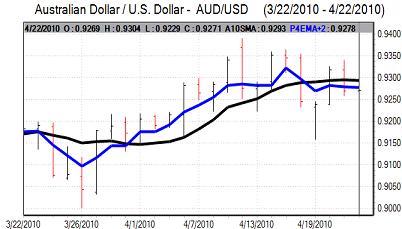

Australian dollar

The domestic producer prices data was slightly stronger than expected, but the impact was limited. There was a generally weaker tone towards risk appetite during the day as Chinese policy fears increased again and the Australian dollar continued to edge lower.

The Australian dollar was unable to make a fresh attack on the 0.93 level against the US dollar and weakened sharply in US trading. As equity markets dipped sharply and European currencies came under heavy selling pressure, the Australian dollar declined to a low near 0.9150.