EUR/USD

The Euro remained under pressure during the European session on Monday, but did find support close to 1.2870 and rallied to the 1.2940 area in New York as the pace of selling slowed with the currency over-sold technically.

The Euro-zone structural vulnerabilities remained an extremely important focus with further concerns that Portuguese yields would continue to rise at auctions this week and that effectively the country would be shut out of markets as debt servicing costs would be prohibitive.

In Asian trading on Tuesday, the Japanese Finance Ministry reported that it was set to buy forthcoming Irish bond issues and this provided important Euro relief on hopes that there would be further Asian buying of Euro-zone bonds after recent supportive comments from Chinese officials.

The underlying situation is still highly uncertain and it will still be difficult to secure a lasting improvement in Euro confidence given that the structural position remains precarious.

There was a tentative improvement in risk appetite during US trading on Monday which dampened any defensive dollar demand. The US currency should still be able to gain some degree of support on yield grounds given expectations of favourable economic data releases this week.

The Euro pushed to a high near 1.30 against the dollar before encountering selling pressure and consolidating close to 1.2950.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

The dollar was unable to regain the 83.30 level against the yen on Monday and retreated sharply to lows near 82.70 during the New York session as the dollar was subjected to selling pressure after failing to break any significant resistance levels.

The yen also gained support from an underlying lack of confidence in the Euro-zone while a weaker tone in the Australian dollar also curbed carry trades funded through the yen.

The Euro found support below 107 against the Japanese currency and reports that Japan would buy Irish bonds had a wider impact in pushing the yen weaker with speculation over additional capital flows out of Japan, although sentiment could again reverse rapidly. The dollar regained the 83 level, but was unable to make further headway.

Sterling

Sterling found support close to 1.5480 against the dollar on Monday and rallied to a high of 1.56 as the US currency weakened from initial highs. The UK currency also maintained a firm tone against the Euro with a test of Euro support below 0.83.

The latest BRC retail sales data recorded the first annual decline for 8 months and there will be further concerns over the outlook for consumer spending, especially as tax increases take effect.

Inflation will also be an important short-term focus, particularly with the Bank of England MPC meeting this week. There will be some speculation that inflation concerns will push the central bank to a tightening bias and this is likely to provide some degree of near-term Sterling support. Volatility is liable to increase as markets focus on UK policy.

Debt issues will also not be far away from the surface and UK confidence will erode rapidly if there are further stresses within the banking sector, especially as new capital requirements will cut underlying profitability.

Sterling consolidated just above 1.5550 against the dollar as weakness in other main economies was the dominant market focus.

Swiss franc

The Euro found support below 1.2450 against the Euro in Europe on Monday and rallied back to above 1.25 with a high near 1.2580 in Asia on Tuesday. There was renewed speculation that the National Bank could intervene to weaken the franc and there was a move to cover short Euro positions which also pushed the dollar to just above 0.97

There will be talks on the franc between government and industry groups this week which will maintain some speculation that there could be policy action, although the government has only a limited role. The central bank will be wary over any sustained commitment given the policy failure during 2010.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

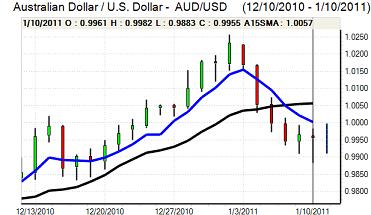

Australian dollar

The Australian dollar was unable to mount a significant challenge on resistance near parity during Monday and then weakened sharply in local trading on Tuesday.

There were increased fears that extensive flooding would damage the economy, especially with exporters starting to face a shortage of export inventory, especially in the coal sector. The recent economic data has also undermined confidence in the economic outlook.

There will still be a degree of confidence in the global economy which will maintain some buying interest on dips.