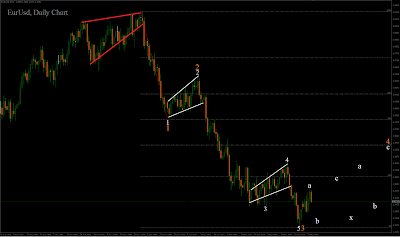

Something misunderstood ? EW is about trading props, sometimes there is high props of upcoming direction, sometimes there is weak upcoming props and sometimes all EW degrees are for different direction. Sometimes there is only 2 possible count exist and once one of them killed, second one is accurate immediately. Sometimes you can be right but for wrong reasons like it seems I was that eur-usd is going to plunge abc correction down. It did, but only a wave at so far.

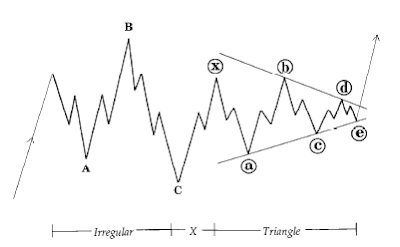

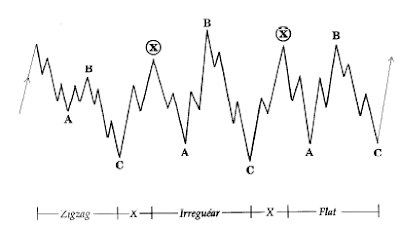

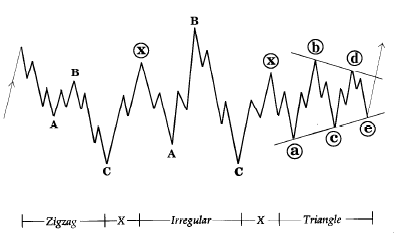

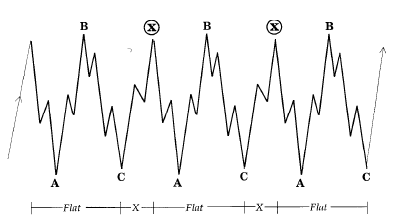

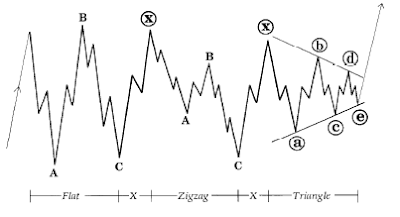

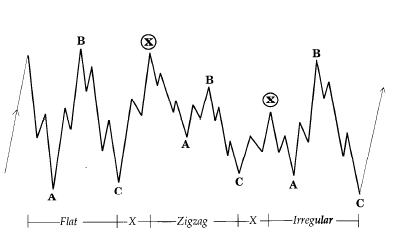

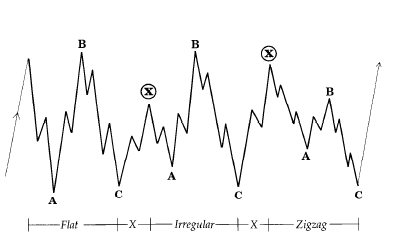

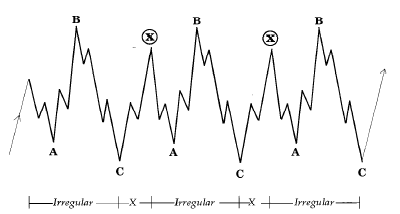

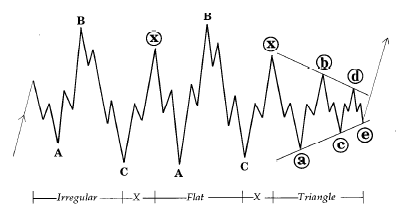

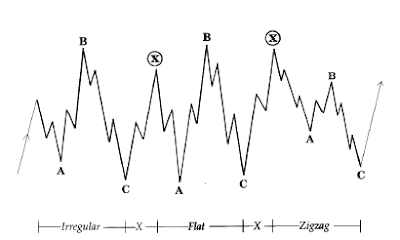

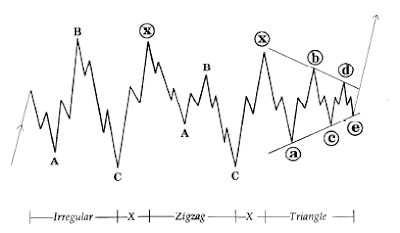

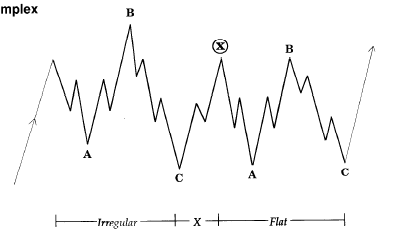

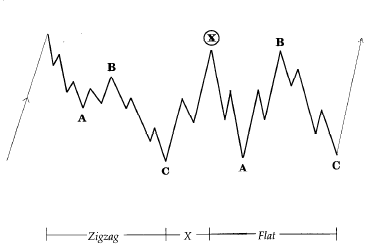

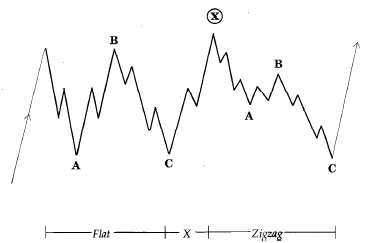

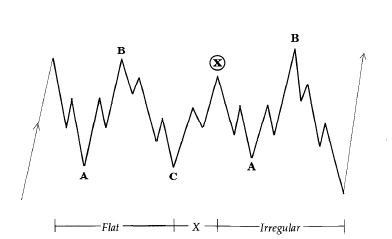

While eur-usd 240 min gave great bear cross again these are 21 choices left if we are still inside of is IV wave. There is also 22:th count choice exist and that is that fifth wave plunge to the 1.30000 is on the progress allready. My opinion ? With minium this B wave is coming with daily chart (while 5 minute chart needs one b wave for upside), but chances are that this IV is going to be very complex since there has not been anything complex in this impulse yet. With that in mind, one of these great 21 complex corrections charts should be accurate for this IV wave, only different is just that it will be bearish (inverse).