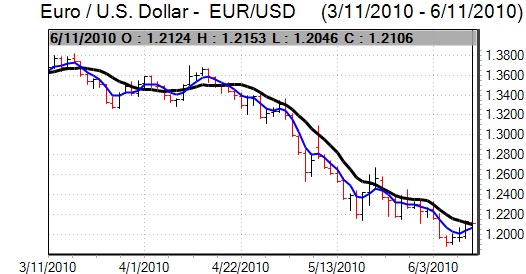

EUR/USD

The Euro found support below 1.22 against the dollar in early Europe on Wednesday, but was unable to make much headway as underlying sentiment remained weak.

The European financial sector remained an important focus, especially with refinancing operations due on Wednesday and Thursday. There was a three-month auction for funds on Wednesday and demand for funds from the ECB was lower than expected at EUR130bn compared with some fears that there could have been demand close to EUR200bn.

The lower than expected figure raised expectations that the much larger 12-month tender on Thursday would also see lower than expected demand and this helped trigger a significant Euro advance on hopes that financing conditions were better than expected.

The US ADP employment data was weaker than expected with private-sector payroll growth at 13,000 for June compared with expectations of a figure near 60,000. The figure will dampen expectations over Friday’s monthly payroll data and will reinforce fears that the economy is set for a deterioration in conditions during the second half of 2010.

Fed officials were also generally downbeat on employment prospects in comments during Wednesday and this maintained expectations of low interest rates which will curb dollar yield support.

The Euro lost ground following the ADP report as risk appetite deteriorated, but there was some recovery following the Chicago PMI report which came in close to expectations at 59.1 for June which helped soothe immediate economic fears. The Euro pushed to a high near 1.23 before retreating back to the 1.2240 area later in the US session.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

During Asian trading on Wednesday, the Finance Ministry declined to comment directly on currency levels, but stated that moves would need to be watched closely. There will be further speculation that the Ministry will look to block further yen gains which will also tend to deter buying support to some extent. Risk appetite was still fragile during the day which maintained some underlying defensive demand for the yen and the dollar was trapped close to the 88.50 area.

The dollar dipped lower following the ADP employment report, but selling pressure was contained and the currency consolidated close to the 88.50 area in New York trade as equity markets attempted to rally.

China’s PMI data will be watched closely on Thursday and any renewed deterioration in the data would tend to provide yen protection on renewed fears over the global economy.

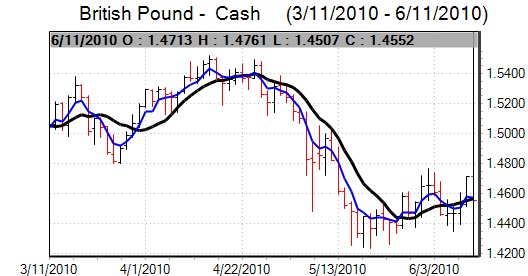

Sterling

The was unable to make a renewed attack on resistance levels above 1.51 against the dollar and had a generally weaker tone during the day. There was some profit taking on short Euro/Sterling positions before the month-end which pushed the Euro back towards 0.82 and this also tended to undermine the UK currency against the dollar.

There were mixed comments from Bank of England member Posen who highlighted the risks of inflation and a renewed downturn in the economy. Uncertainty will remain a key short-term feature and the fluctuations in sentiment is also likely to lead to additional Sterling volatility.

Trends in risk appetite were important during the day and the UK currency was unsettled when confidence deteriorated. Sterling consolidated below 1.50 against the dollar later in the US session.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Swiss franc

The dollar was blocked close to 1.0850 against the franc on Wednesday and there was renewed downward pressure on the US currency during New York trading with a low close to 1.0750. The Euro remained under pressure against the franc as it tested fresh record lows below 1.32.

The KOF business confidence index edged higher to 2.25 in the latest month from 2.16 the previous month which will maintain underlying confidence surrounding the Swiss economy. The robust reading will also lessen pressure on the National Bank to intervene and restrain the franc which will tend to maintain a robust currency tone in the near term.

Australian dollar

The Australian dollar was able to find support below 0.85 against the US dollar in early Europe on Wednesday and recovered to a high around 0.8560 following the Euro recovery and improvement in risk appetite.

The Australian dollar was unable to sustain the gains and weakened to lows below 0.8450 in New York as equity markets hesitated and there was fresh downward pressure on commodity prices.

The currency will be vulnerable to further selling pressure if there is weak Chinese data on Thursday.