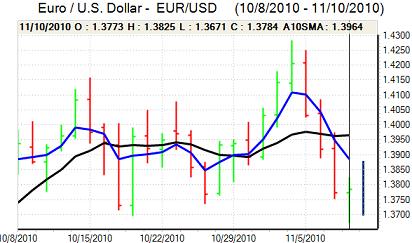

EUR/USD

The Euro again failed to sustain a rebound on Wednesday and from highs above 1.3820, retreated to lows below 1.37 against the dollar, the lowest level since mid October.

There were persistent concerns over the Euro-zone outlook which was also an important factor undermining the Euro. There was a further sharp widening of Irish bond yields during the day. There was evidence of distress selling with funds unable or unwilling to meet the new margin requirements. If yields continue to rise, there will be further speculation that an IMF bailout will be required and there will also be fears that the banking sector will come under renewed stress and require increased support.

The US economic data caused some grounds for optimism with jobless claims declining to 435,000 in the latest week from a revised 459,000 previously. The trade deficit narrowed slightly with a rise in trade volumes providing some support to growth hopes.

There was a rise in US Treasury yields, partly related to the economic data and partly related to disappointing bond auctions. Such an outcome certainly has two-way risks for the dollar as there will be fears that international investors are losing interest, but the currency did secure net support from a rise in rates as 10-year yields rose to a 7-week high.

US and global currency policies will remain in focus during the G20 meetings which will maintain the risk of volatility, although the impact may be dampened by a US market holiday on Thursday. The underlying tensions are likely to maintain some degree of risk aversion which would tend to curb selling pressure on the dollar.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

The dollar secured further support in European and early US trading on Wednesday. There was a fresh attack on resistance levels near 82 against the Japanese currency and a break of this level triggered a renewed bout of stop-loss dollar buying which propelled it to a high near 82.80.

The US currency gained some support from a rise in US yields and there was also evidence that long-term dollar bearish positions were being closed.

Risk appetite was slightly more cautious in Asian trading on Thursday with tighter Chinese reserve requirements and a higher than expected inflation rate increasing fears that China would need to take additional monetary-tightening. The US currency retreated back to near 82 before finding fresh support.

Sterling

Sterling continued to test support levels below 1.60 against the dollar ahead of the Bank of England inflation report, but selling pressure was contained.

In the quarterly report, the central bank did raise the inflation forecasts, although the median outcome was that inflation would be below the 2.0% target in two years’ time.

The bank expressed a high degree of uncertainty over the potential outcome and also stated that policy could be adjusted in either direction according to economic developments. It is clear that the bank remains very uncertain over likely policy developments, but the net impact was to dampen expectations of further near-term monetary easing which underpinned Sterling.

The UK currency is also gaining protection from the fact that its not the dollar or the Euro. In this environment, there were renewed gains for the currency with a move back to test resistance above 1.6150 against the dollar with the Euro at 7-week lows below 0.86.

Swiss franc

The Euro did find support close to 1.33 against the franc on Wednesday, but was unable to secure much of a recovery with selling pressure above 1.34. The dollar advanced to highs near 0.9765 before retreating back towards 0.97.

The franc will continue to gain defensive support from stressed within the Euro-zone bond markets with the currency seen as an important haven from regional capital-market tensions. There will still be some caution over potential National Bank protests against currency strength which will tend to deter more speculative buying.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

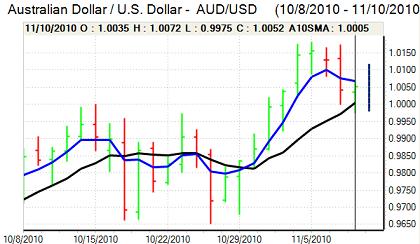

Australian dollar

The Australian dollar found support close to parity against the US dollar on Wednesday and stabilised in the 1.0050.

The latest labour-market data triggered a further test of support below 1.00 as the unemployment rate rose sharply to 5.4% from 5.0%. There was a rise in employment, but this was centred around a gain in part-time jobs as full-time employment fell. The data will help maintain doubts over the underlying economic performance and is likely to curb Australian dollar buying.

A sustained increase in risk aversion would also be negative, but there was still solid buying on dips with a move back above parity later in Asia.