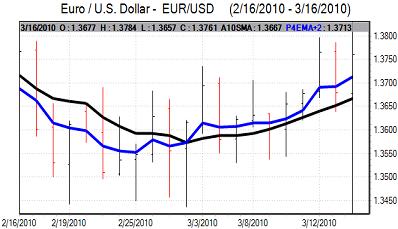

EUR/USD

The Euro held a steady tone in early Europe on Tuesday. The German ZEW index was firmer than expected at 44.5 for March which had some positive impact on Euro sentiment even though this was slightly lower than 45.1 for February.

EU Finance Ministers agreed an emergency loan-support scheme for Greece which helped underpin sentiment towards the Euro. There was also a statement from ratings agency Standard & Poor’s reaffirming Greece’s credit rating. Markets had been braced for a further cut in the rating and the announcement encouraged the trend of covering short Euro positions. With risk appetite also firmer and evidence of equity inflows, the Euro was able to strengthen above 1.37 ahead of the Fed interest rate decision.

The US housing data was in line with market expectations as starts fell 5.9% to an annualised rate of 0.57mn while permits held firm and this did not have a significant market impact.

As expected, the Federal Reserve left Fed funds interest rates at 0.0- 0.25% following the latest FOMC meeting. In the accompanying statement, the Fed also maintained the phrase that interest rates would be kept at exceptionally low levels for an extended period. There was a 9-1 vote for the second meeting in succession as Regional Fed Governor Hoenig dissented and called for the extended-period language to be dropped.

The Fed was slightly more optimistic in its assessment of the economy, but there will not be any increase in expectations of a near-term move on rates which will curb dollar support. The US currency weakened immediately following the decision, but recovered from lows beyond 1.3770.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

There was evidence of Japanese exporter selling during Asian trading on Tuesday and there was also some speculation of capital repatriation ahead of the fiscal year-end. There was stop-loss selling and speculative yen buying which triggered a test of dollar support near the 90 level.

The dollar found support close to this level and fluctuated around the 90.50 level for much of the day before retreating towards 90.25.

Risk appetite was generally firm during the day which limited yen support on the crosses and the Euro consolidated above 124.20. The yen will tend to weaken slightly if the Bank of Japan announces further monetary easing on Wednesday. Tensions between the US and China over the yuan will tend to provide some yen support.

Sterling

Sterling initially held around 1.5050 against the dollar in early Europe on Tuesday. A report from the European Commission calling for more decisive measures on the UK budget deficit triggered a sharp dip to below 1.50 before a recovery to near 1.51 in choppy conditions.

The latest government house-price data was stronger than expected with a reported 6.2% increase in prices in the year to January. The latest opinion polls also suggested a greater chance of a decisive election result which helped improve Sterling sentiment slightly.

There was still a mood of short covering which helped underpin the UK currency and there were gains to a high above 1.52 following the US Federal Reserve interest rate decision.

The Bank of England minutes and employment data will be important on Wednesday and could provide some Sterling support. Bank deputy Governor Bean was still very cautious over the economic outlook which may stem currency support, but Sterling held above 1.52 in New York

Swiss franc

The dollar was blocked around 1.0620 against the franc on Monday and weakened to test lows below 1.0550. The Euro continued to test support levels near 1.45 against the Swiss currency.

There was again no evidence of National Bank intervention to weaken the Swiss currency which continued to fuel speculation that the bank would be more tolerant of franc strength over the next few weeks.

Markets will continue to probe Euro support levels unless there is a stronger signal from the central bank.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

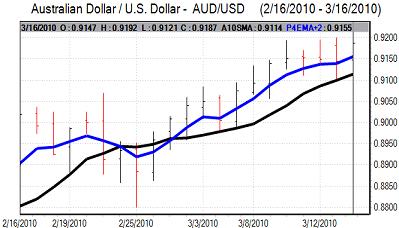

Australian dollar

The Australian dollar has found it difficult to secure any fresh momentum even though the US currency has generally been on the defensive. The latest RBA minutes were slightly less hawkish than expected which dampened support and there has also been some selling evident on the main crosses.

The FOMC statement provided another trigger for US currency losses and the Australian dollar moved to highs near 0.92 as risk appetite was also generally firm.