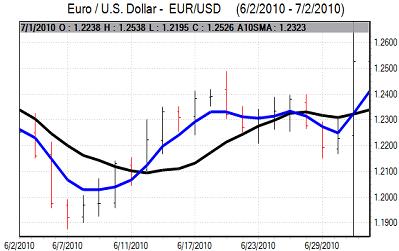

EUR/USD

The Euro edged marginally weaker in European trading on Monday in quiet conditions and narrow ranges ahead of the US Independence Day market holiday. Market positioning will be important and a sustained reduction in short Euro positions will tend to lessen the potential for a further covering which will also make it more difficult for the Euro to advance further.

ECB President Trichet urged further fiscal tightening by Euro-zone countries which helped maintain underlying growth fears surrounding the region. There was also evidence of persistent stresses within the financial markets with Euro Libor rates rising to a 10-month high and there will continue to be fears over liquidity stresses

The Euro-zone Sentix index remained in negative territory for July, but was stronger than expected at -1.3 from -4.1 the previous month which should provide some degree of relief over near-term economic conditions.

Trading conditions were very thin in the US session with the Euro able to consolidate above the 1.25 level.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

Asian equity markets were slightly firmer on Monday which curbed defensive demand for the Japanese yen on defensive grounds. There was still a high degree of caution over global growth prospects which curbed interest in carry trades, especially with volatility in the Australian dollar and selling pressure on the yen was muted.

The dollar edged higher to the 88 area in early Europe with some speculation that there was semi-official yen selling during the session. With no further impetus during the New York session, the dollar was unable to make further headway and persistent doubts surrounding the global economy also provided background support for the yen.

Sterling

Sterling was unable to make a significant attack on resistance above 1.52 against the dollar in early Europe on Monday and tended to drift weaker during the day.

The CIPS services-sector index weakened to a 10-month low of 54.4 for June from 55.4 the previous month. This downturn will tend to reinforce second-half growth fears, especially with expectations of further budget tightening by the government.

NIESR member Weale has been appointed to the Bank of England Monetary Policy Committee from August and there should not be a substantial policy impact. There will tend to be reduced expectations of a near-term move to increase interest rates which will also tend to sap Sterling support.

The UK currency dipped to a low around 1.5090 before consolidating just above 1.51 in very subdued US trading conditions. There was support close to 0.83 against the Euro.

Swiss franc

The dollar found support on a retreat towards 1.06 against the franc on Monday, but was unable to make a break back above 1.07 as ranges narrowed. The Euro was able to maintain a firmer tone just above 1.33 against the franc on a covering of short Euro positions.

National Bank Chairman Hildebrand stated that the bank was monitoring exchange rates closely and this will create some caution over buying the franc aggressively as there will be some renewed unease over the threat of intervention.

There will still tend to be defensive franc demand given the underlying increase in risk aversion.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

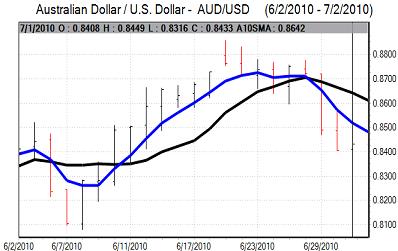

Australian dollar

There was an Australian dollar retreat to below the 0.84 level in early Asia on Monday before a recovery back to the 0.8460 area as risk appetite attempted to recover. The economic data was generally weak with the PMI services-sector index below 50. There was uncertainty over the RBA Tuesday interest rate decision and the currency will come under heavy selling pressure if rates are cut, although unchanged rates look more likely.

There will be persistent fears over the global economy and this is likely to undermine confidence in the Australian currency. Global freight rates have weakened without break for the longest period for 5 years which will tend to reinforce fears over potential commodity-price trends and also unsettle the Australian currency.