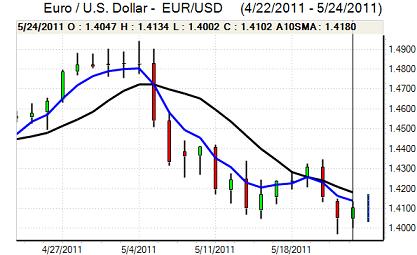

EUR/USD

The Euro found support above 1.40 against the dollar during Wednesday with reports that option positions were being defended and, after a period of range trading, the currency pushed sharply higher late in the US session with a high above 1.4170.

There was evidence of position adjustment after support held and the Euro was also boosted by media reports that China was looking to increase its buying of Euro-zone bonds.

There were still extremely important Euro vulnerabilities with no end in sight for the Greek crisis. EU commissioner Damanaki stated that Greece’s future in the Euro area was at risk while the government denied that it would hold a referendum on further austerity measures. With market pressures increasing and time running out markets are increasingly concluding that either huge long-term fiscal transfers to weaker Euro countries will be required or that there will need to be a radical change in the Euro structure. Inevitably, the ECB remains strongly opposed to any debt restructuring as this would severely damage the central bank and confidence remains extremely fragile.

The US economic data was again weaker than expected with a 3.6% decline in headline durable goods orders following a revised 4.2% gain previously while there was a second successive decline in US house prices. The data will reinforce market speculation that the Federal Reserve will maintain a dovish policy stance over the next few months. The Euro drifted weaker in Asia on Thursday, although it held comfortably above the 1.40 region.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

The dollar was trapped within relatively narrow ranges against the yen during Wednesday as attention was focussed on the European and US. The dollar was unable to break above the 82.20 area, but found support on dips to the 81.80 region as there were choppy yen movements on the main crosses.

There has been a clear shift away from the yen as a safe-haven with the currency finding it much more difficult to gain support when risk appetite deteriorates. There should still be some degree of support for the Japanese currency when equity markets are subjected to heavy selling pressure.

There has also been speculation over longer-term capital repatriation of assets by Japanese funds, especially given the domestic debt burden and demographics. These capital flows would provide some important protection for the yen.

Sterling

Sterling found support below 1.6150 against the dollar during Wednesday and advanced steadily higher with a peak above 1.6320 as the US currency retreated. The UK currency also gained some support at the Euro’s expense and strengthened to a peak beyond 0.8650 before a partial retreat.

Revised first-quarter GDP was in line with the original estimate at 0.5% with weakness in consumer spending offset by gains in net exports. There was also a recovery in services-sector activity according to the latest data. There was, however, a sharp 7.1% decline in quarterly investment which will cause concern and there was also a further decline in mortgage approvals according to the latest data which will maintain fears over the housing sector.

For now, Sterling is gaining some degree of support from the Euro-zone stresses as the Euro remains under pressure against the European crosses. It will be difficult to secure further support given vulnerability within the UK financial sector. Sterling consolidated just above 1.63 against the dollar in Asia on Thursday.

Swiss franc

The dollar was unable to make any impression on the franc during Wednesday and there was renewed selling pressure during the US session with a decline to lows near 0.87. Market attention also remained on the Swiss crosses as the Euro came under heavy selling pressure with a decline to fresh record lows below 1.23.

The franc continued to gain support from Euro-zone sovereign-debt fears amid speculation over capital flight and the potential inflows have been magnified by the fact that Japan is no longer seen as a viable safe-haven currency. National Bank actions will remain an important focus as there will be strong pressure for the bank to intervene.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

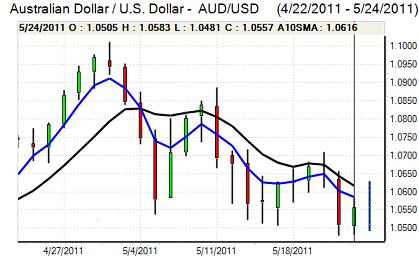

Australian dollar

The Australian dollar remained under pressure during the European session on Wednesday and retreated to fresh 8-week lows below 1.0450 against the US dollar as risk appetite deteriorated. The US currency was unable to sustain the gains and weakened back to the 1.06 area on a wider decline and a rally in commodity prices.

The domestic economic data was stronger than expected with a gain for capital spending in the first quarter. There will still be unease over the risk of a sharp slowdown in regional demand which will also maintain the threat of erratic trading conditions in the short term.