The Shanghai Composite fell 3% this morning.

The Shanghai Composite fell 3% this morning.

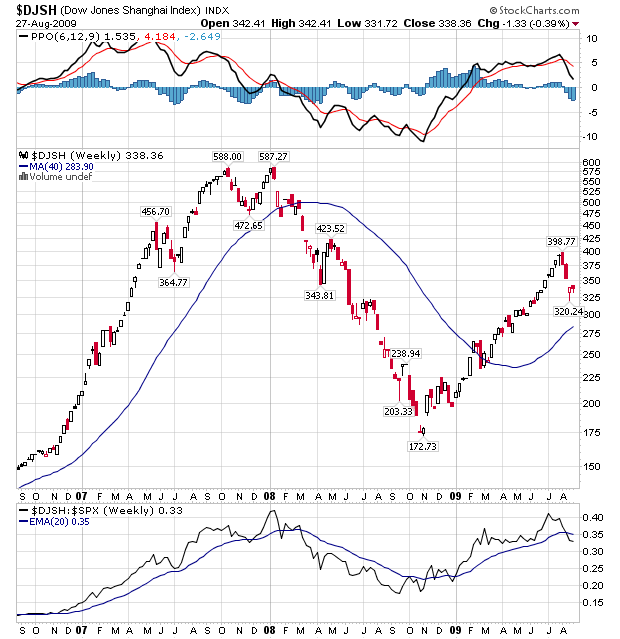

That drops them to 328, down from 398 on August first (-17.5%), which is almost a perfect 20% retrace off the run from the last consolidation at 250in March. As you can seefrom the chart, weare about midway between the high for the year and a 50% retrace of the entire run from the bottom at about 280, which happens to be the 40-week moving average. This is significant in many waysas the Chinese market has been the driver of the global recovery and our globalmarkets (and our localstocks and indexes) are all flying high above their 200dmas, just about where China was 30 days ago.

I am sorry to be the annoying voice of caution the past two weeks but, when I was akid, “Spinning Wheel” was a hit song and “what goes up must come down” is etched into some very deep neural pathways in my brain. We’ve been using the FXP (ultra-short China) as acover for almost exactly a month as I had put my foot down when the Shanghai hit 400 and the Hang Seng hit 21,200, up exactly 100% from their November lows.

As David Fry points out in his daily S&P chart, the volume for the days is DOWN volume and, once the sellers get their fill, the auto-bots come out to play and run the markets back up. I pointed out on Wednesday, close to 40% of the entire volume of the markets is centered around 4 stocks (C, FNM, BAC and FRE). Throw in AIG’s 150M shares and we’re getting close to ONE HALF of the total market volume in 5 stocks.

As David Fry points out in his daily S&P chart, the volume for the days is DOWN volume and, once the sellers get their fill, the auto-bots come out to play and run the markets back up. I pointed out on Wednesday, close to 40% of the entire volume of the markets is centered around 4 stocks (C, FNM, BAC and FRE). Throw in AIG’s 150M shares and we’re getting close to ONE HALF of the total market volume in 5 stocks.

While that may be shocking and ridiculous and has now been pointed out by several analysts, what I’m not seeing discussed is the implication that holds for the rest of the market. If those 5 stocks are 50% then the market, which is already trading at historically low volumes, is actually trading 50% LOWER than that! Then we have the well documented indications that GS, CS and a handful of other firms account for 40% of all trading volume. That means, if GS and other manipulators aren’t trading those 5 stocks, then they are accounting for 80% of all remaining transactions!

More likely the real number is somewhere in-between. Perhaps half their trades are in the Big 5 so that would be 40% of 50% of the market volumeallocated…