It’s that time of the year— my favorite time of the year.

I had a friend ask me recently “what is my favorite season?” I thought about it. Summer is for sure a close second. Apparently, I do love the fall season. Let’s mull it over for a second. My favorite game of the year? When the Florida Gators vs. the Georgia Bull Dogs, known as the world’s largest outdoor cocktail party. College football in general! Uhh, hello? Awesome, right? The NFL, pumpkin beers, cold weather, the World Series. Leaves beginning to change colors, cascading upon the anxious black pavement, providing a rich, colorful scene for any picturesque car commercial. In the fall season there’s also Thanksgiving, which is always a blessing to spend time with friends and loved ones.

MACY’S EARNINGS

One thing that’s always slightly comical about the fall season…is the always eager embrace of winter (at least when it comes to music). It’s seems business owners and stores alike just can’t wait to turn on the Christmas music. If you go into a Macy’s – you will hear said music, blaring ever so vibrantly through their ceiling and decorative rock speakers. I bring up Macy’s because the stock crushed its earnings expectations. Hugh Johnson, the CIO and founder of HJ Advisors said Macy’s had “surprising numbers.” The company’s earnings of 47-cents a share topped analyst’s estimates by 8 cents. Topline revenue also beat, with Macy’s reporting sales of $6.28 billion, besting the consensus estimate of $6.19 billion.” That’s a big deal coming into the Holiday shopping season.

THE CHART

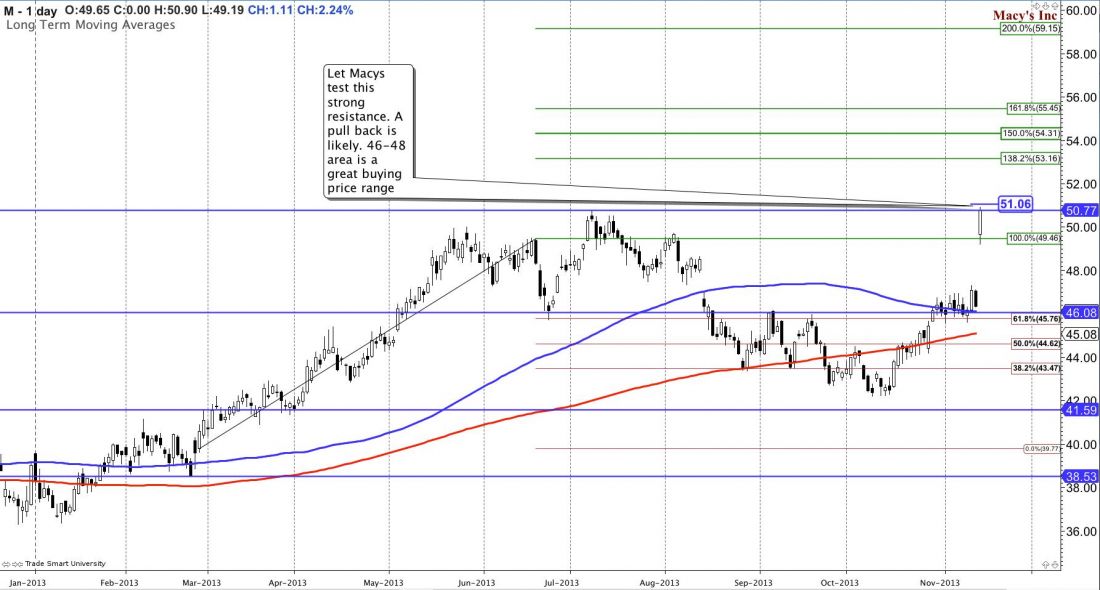

Let’s look at this chart from a technical perspective. I’ve got some confessing to do though. I did go bearish on M on 10/8/2013 and got stopped out on 10/16/13. I love celebrating stops. I mean…what if I would have held onto that trade, right? That’s what discipline is, doing the right thing regardless of if it feels good or not. Ok, so on M, I got stopped out on the bearish trade; love it! I mitigated losses. From here, with this gap on earnings, M now has what I call a double gap. The $47.50 price area had a prior gap back in August. So this gap action is now a double strong support. With that fact, along with the price action of Macy’s being above the 100 and 200 simple moving averages, above the 10, 20, 50 exponential moving averages, the only thing from here is for Macy’s to close above the resistance level around $50.77.

LOOK FOR A PULLBACK

As my “trading plan” stipulates as well, it wouldn’t be the worst trade in the world to buy into Macy’s as it pulls back and bounces (if it does). Otherwise, a close above $51.60 and I could see some great bullish potential. If you are a trader / investor who wouldn’t mind owning shares of Macy’s you could sell the $47 or $48 Dec or Jan Put.

Both pay a very good premium and are at a good location if you are put the stock there. Because then the $50 covered call could be sold. I added some Fibonacci analysis for you, to help you determine future targets on this stock. Let’s get a break of that resistance and the Santa Clause rally could be in full affect.

Remember, friends, plan your trade and trade your plan!

= = =