Many believe the VIX is the “be all, end all” indicator to explain sentiment. Yet, there is a misconception about what it really means and how to trade around it.

A misconception exists: a low VIX cash reading shows complacency while a high reading reflects fear. Well, this is only partially right —taken in the right context.

LOOK FOR EXTREMES

I will look for extremes on VIX readings and other sentiment indicators, and how I do this is measuring versus volatility bands, or in this case Bollinger bands. A spike through an upper or lower band tells us there is extreme activity or exhaustion and a reversal may be at hand. Further, a range-bound VIX that lies stable and within the bands may reflect a ‘rest’ period before a big move is to occur. I generally like to play moves off the bands, where the volatility is really starting to heat up.

FUTURES ARE MORE IMPORTANT

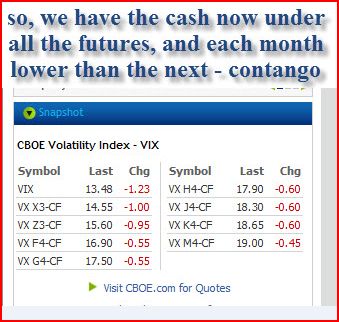

But, there is another element — the futures. VIX futures are really much more important than VIX cash, because we really only care what the market believe movements will be in the future. The cash VIX represents the sentiment at the moment, so when that cash shoots higher and even surpasses the futures (called backwardation). We’ve had that a few times this year, and that condition of high fear threatens the bull market – severely. Recently it happened again (fear of the debt ceiling crisis) but fortunately the excess fear receded.

WHAT THE VIX SAYS NOW

Currently, the futures are in an upward sloping curve, in contango —which it has been for 98% of 2013….reflecting a bullish condition. When it changes, we’ll know it here.