EUR/USD

The Euro was pushed sharply higher in European trading on Tuesday with a technical move following the Swiss National Bank move to weaken the franc. There was a very rapid advance for the Euro against the franc which also pushed the currency higher against the dollar with a peak near 1.4250 before a sharp reversal.

There was still an important lack of confidence in the Euro area which undermined the currency later in the session. The German constitutional Court will make a ruling on the legality of German bailout payments on Wednesday and there were some concerns that any judgement requiring greater parliamentary scrutiny would make it even more difficult for the government to secure approval for an expansion of the EFSF. A test vote this week showed that there are already a significant number of dissenters within the governing collation

There was further uncertainty surrounding Greece with the German Finance Minister stating that the next loan tranche to Greece could not be paid unless there was a favourable report on Greece’s progress from the IMF-led troika. There were also further concerns surrounding the revised Italian austerity package which is being debated in parliament this week.

Fears over a deterioration in growth conditions also put downward pressure on the Euro with banking-sector shares continuing to fall sharply amid speculation that the ECB would take a more dovish tone.

The US ISM index for the services-sector was stronger than expected with a rise to 53.3 in August from 52.7 previously which provide some relief, although the underlying components were still fragile. The Euro dipped to 7-week lows below 1.40 before finding some support.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

The dollar pushed higher against the yen on Tuesday with a peak close to 77.60 before a retreat to the 77.25 area. The Swiss move to weaken the franc triggered speculation that the Japanese Finance Ministry and Bank of Japan would take more aggressive action to weaken the yen which provided some initial dollar support.

From a medium-term perspective, the National Bank determination to weaken the Swiss franc could trigger additional flows into the Japanese currency as an alternative safe-haven. The yen will also continue to gain defensive support from a lack of confidence in the Euro-zone and fears over the global economy.

The Bank of Japan left interest rates on hold below 0.10% following the latest council meeting and did not announce any further quantitative easing. There will be pressure for additional action if the yen draws strong safe-haven support.

Sterling

Sterling briefly advanced against the dollar in line with a weaker US currency against the Euro, but Sterling was quickly subjected to fresh selling pressure and from highs above 1.6150 dipped to 7-week lows below 1.60 during the New York session while the Euro held small gains against Sterling.

The UK currency was again unsettled by weak risk appetite with little apparent support as a safe-haven at this time.

Following the weak services-sector data this week, there was also additional speculation that the Bank of England would take additional action to support the economy in the form of additional quantitative easing. There was also speculation that the government would need to adjust fiscal policy if growth conditions continued to deteriorate.

Swiss franc

The Swiss National Bank announced on Tuesday that it had set a minimum rate for the Euro against the franc of 1.20. The central bank stated that it could no longer tolerate the severe over-valuation of the currency given the increased risk of recession and deflation within the Swiss economy.

The bank would also intervene without limit to defend the 1.20 level to prevent further franc appreciation. The bank stated that it was acting independently and not in co-ordination with any other central banks.

Inevitably, the franc weakened extremely sharply following the announcement with the Euro advancing to just above the 1.20 level from below 1.11 while the dollar advanced to above 0.8550 which was the strongest level since late May

There will be reduced short-term demand for the franc on safe-haven grounds with markets reluctant to take on the central bank, but the Bank could be severely tested if Euro-zone tensions intensify over the next few weeks.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Australian dollar

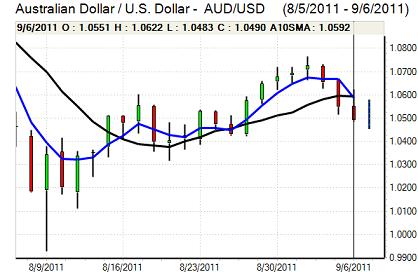

The Australian dollar found support just below the 1.05 level against the US currency on Tuesday and pushed higher again in Asia on Wednesday with a peak just above 1.06. The currency was broadly resilient in the face of a further deterioration in risk appetite even when equity markets fell sharply.

There was some support for the currency as an alternative safe-haven given that the Swiss National Bank was blocked capital flows into the franc. Reserve Bank Governor Stevens remained broadly optimistic over the economic outlook which also provided support for the currency. There was, however, further negative data surrounding the building sector with the construction PMI index declining further to 32.1 for August from 36.1