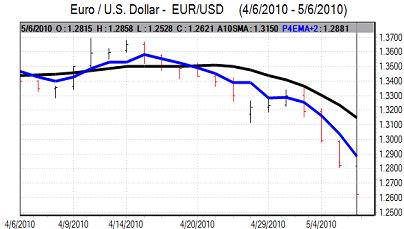

EUR/USD

The Euro consolidated just above 1.28 in early Europe on Thursday with pressure for a limited technical correction. The currency was unable to secure sustained relief and retreated to fresh 14-month lows near 1.27 ahead of the ECB meeting as sentiment remained extremely weak.

Yield spreads widened on fears over a further contagion threat. There was also further speculation that Portugal and Spain would also require multilateral support.

The financial sector was also an important focus with fears of renewed stresses within capital markets and renewed losses within the banking sector which could trigger a renewed credit crunch.

There had been some speculation that the ECB would cut interest rates at the latest council meeting, but rates were left on hold at 1.0%. In the press conference following the meeting, Trichet stated that there had been no discussion of the bank buying bonds. Trichet stated that there was no possibility of Greece defaulting on its debt.

The latest US jobless claims data recorded a decline to 444,000 in the latest week from 451,000 previously which did not have a substantial impact as markets remained focussed on the European situation. Only a very large employment gain may trigger a big independent market reaction on Friday.

There was an increase in the 3-month Libor rate during the day which also raised some concerns that financial contagion was spreading. Underlying confidence in the Euro remained extremely weak during the day. Selling pressure intensified during the US session and the Euro weakened to a low near 1.25 in frenetic conditions as Wall Street plunged before recovering back to 1.2615.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

Japanese markets re-opened on Thursday after a three-day holiday and exporters took advantage of the firmer dollar to sell the US currency which helped underpin the yen to some extent. Risk appetite was also still generally fragile and the dollar edged lower to the 93.60 area.

The yen was firm on the crosses and the Euro tested important support levels close to 120 as European sentiment remained weak with some speculation over capital repatriation as Japanese equity markets fell sharply.

Risk appetite deteriorated sharply during the day which triggered fresh demand for the Japanese currency. The dollar retreated very sharply to lows below 88.50 against the yen as Wall Street plunged while the Euro remained under severe pressure with lows below the 111 level. Some degree of calm returned later in the session with the dollar moving back above the 90 level.

Sterling

Sterling weakened to lows near 1.50 against the dollar in early Europe on Thursday. The services-sector PMI index was weaker than expected at 55.2 from 56.5 the previous month which will undermine economic sentiment to some extent.

The election result will inevitably be important for confidence surrounding UK government debt and Sterling. Early exit polls suggested that there was an indecisive result. Underlying confidence is likely to remain very fragile, especially with the fact that sovereign debt fears have increased. In this environment, there will be the threat of a sharp deterioration in Sterling sentiment.

Risk appetite deteriorated very sharply during the day and this pushed the UK currency sharply weaker with a plunge to lows near 1.47 in New York before a recovery to 1.48.

Swiss franc

The dollar pushed to a high near 1.1250 against the Swiss franc on Thursday, but then weakened to lows near 1.10 as there were huge franc gains on the crosses before the dollar consolidated close to the 1.1120 area.

The Euro has been stuck close to 1.4320 against the Swiss currency for days, underpinned only by National Bank intervention. During Thursday, the central bank effectively stopped intervening in the markets and this put the Euro under severe selling pressure. The Euro weakened to a low close to the 1.40 level which was a record low for the Euro before some stabilisation.

Volatility levels are likely to remain higher in the short term and there will still be the potential for defensive inflows into the Swiss currency on Euro-zone fears.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

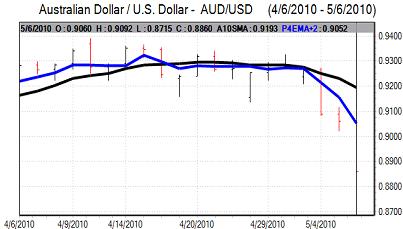

Australian dollar

The domestic data was weaker than expected with a 0.3% increase in retail sales for the latest month which will curb expectations of higher interest rates. Risk appetite remained extremely fragile and there was a renewed test of support below the 0.90 level against the US dollar on Thursday.

Trends in global risk appetite dominated over the remainder of the day and there was intense selling pressure on the currency in New York trade with the currency plunging to a low near 0.87 as equity markets fell very sharply. The Australian dollar rallied back to the 0.8850 area as the US session closed.