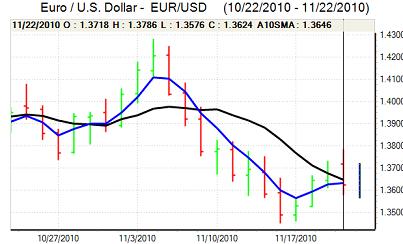

EUR/USD

The Euro initially maintained a firm tone on Monday and peaked at 1.3785 against the dollar, but was then subjected to renewed and persistent selling pressure during the Europeans session.

Relief following Ireland’s decision to seek a support package from the EU proved short-lived with further difficulties within Ireland and the wider Euro area. The Irish government announced that it would resign and hold an election immediately after the emergency budget is passed. This increased fears that the support package would be jeopardised by political uncertainty and posturing which had a negative impact on sentiment.

There were also warnings from credit ratings agency Moody’s that the further substantial increase in government debt following additional support for the banks would trigger another round of substantial ratings downgrades.

As well as the Irish situation, there were further stresses surrounding Portugal’s debt markets while there was also unease surrounding the Spanish banking sector and savings banks. With fears over a wider contagion effect, underlying sentiment surrounding the Euro remained negative.

There were no major US developments during the day with attention focussed firmly on the Euro-zone situation as the technical picture for the currency also deteriorated. The Euro dipped to lows just below 1.3550 before stabilising during the Asian session on Tuesday.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

The dollar was blocked in the 83.50 area against the yen during Monday, but found support on retreats towards 83.20 with generally narrow ranges.

The US currency was undermined to some extent by a decline in US Treasury yields, but there was still firm buying support on dips which limited potential selling pressure.

The yen was underpinned on the crosses by a fresh deterioration in risk appetite and the credit-ratings warning over New Zealand will also tend to dampen capital outflows into high-yield currencies which should offer some degree of protection. Trading conditions were subdued in Asia on Tuesday with Japanese markets closed for a holiday.

Sterling

Sterling peaked just above 1.6070 against the dollar on Monday and was then subjected to renewed selling pressure with lows just below 1.59. The wider Euro/dollar moves were the dominant influence on Sterling with the Euro able to hold above the 0.85 level as several large orders were noted on the cross.

Markets will continue to focus strongly on Bank of England MPC member comments over the next few days. The two dissenters at recent meetings, Sentance and Posen, are due to make speeches this week and all the members are due to give evidence to the Treasury select committee on Thursday.

Any suggestions of a change in stance by members would have an important impact on Sterling sentiment.

Sterling will tend to be vulnerable to some selling pressure if there is a sustained deterioration in global risk appetite, especially if the UK commercial banks need to make fresh loan provisions.

Swiss franc

The Euro peaked near 1.3650 against the franc on Monday and was then subjected to substantial selling pressure as fears over the Euro-zone returned and the currency dipped to lows near 1.34 during the US session. In this environment, the dollar was unable to make ay headway against the Swiss currency and consolidated near 0.99.

The franc will continue to gain defensive support when confidence in the Euro-zone falters and there remains a small possibility of a much more substantial and potentially destabilising capital flight from the Euro area which could trigger heavy franc buying.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

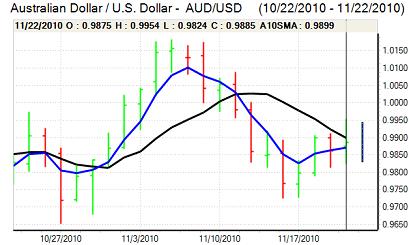

Australian dollar

The Australian dollar has been subjected to further volatility over the past 24 hours as global uncertainties persist. After a peak just above 0.9950 against the US currency, the Australian dollar fell sharply with lows below 0.9825. International risk appetite was generally weaker which discouraged capital flows into the Australian dollar.

Regionally, a ratings warning over New Zealand debt also had an important negative influence on the Australian dollar. Domestically, there will be unease over the risk of a sharp slowdown in consumer spending and the main feature is likely to be further bouts of high volatility over the next few days.