EUR/USD

The Euro was unable to regain the 1.40 level against the dollar in European trading on Tuesday and weakened steadily during the session with a low near 1.3860 before stabilising. The currency remained vulnerable to a correction following sharp gains the previous week, especially with long speculative Euro positions over-extended. The US currency also gained some support from a decline in oil prices.

There were also fundamental doubts which put downward pressure on the Euro. There were fears over sovereign credit ratings as yield spreads continued to widen and bond auctions will also continue to be watched closely to assess investor demand for European debt. There will also be a high degree of caution ahead of Friday’s EU Summit with fears that policy differences will intensify.

There were further robust comments on inflation and interest rates from ECB council member Weber and at this stage there is no evidence that the ECB is backing away from an April interest rate increase with. The Euro will gain support on yield grounds if fundamental doubts can be kept at bay.

There was a decline in a US consumer confidence reading, which did not have a major impact, although Treasury yields did edge slightly lower. Markets will remain on high alert for comments from Federal Reserve officials ahead of the March 15th FOMC meeting. There has been further speculation that the central bank will signal that quantitative easing will not be extended beyond June and that the Fed will want to signal this in advance. The dollar could gain strong support if there are hints of a policy shift next week.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

The dollar found solid support on dips towards the 82.20 area on Tuesday and advanced firmly during the European session. A break above 82.60 triggered further demand for the US currency and it peaked near 83.0 in the Asian session on Wednesday.

The US currency continued to gain underlying support on yield grounds with evidence of strong investment inflows. There was also support from an easing of risk aversion as lower oil prices triggered a decline in defensive yen demand.

Domestically, there was a 4.2% increase in machinery orders for February which will underpin sentiment towards the economy, but there will be unease over regional economic trends and the risk of a growth slowdown later in 2011.

Sterling

Sterling was unable to gain any fresh support in European trading on Tuesday and wider US dollar gains helped push the currency to lows near 1.6120 before stabilising in the 1.6150 area. The technical picture for the currency has deteriorated which tended to increase selling pressure.

The latest BRC shop-price index recorded an annual rise of 2.7% from 2.5% the previous month which will sustain fears over higher inflation and maintain pressure for the Bank of England to tighten policy. There have also been increased fears over the growth outlook with consumer spending set to remain under pressure and there will certainly be a vigorous debate at the MPC policy meeting which starts on Wednesday.

There will tend be reservations over selling the UK currency ahead of the interest rate decision and any sustained improvement in risk appetite would also tend to have a positive influence on the currency. Sterling held above 1.61 in Asian trading on Wednesday, but remained fragile.

Swiss franc

The dollar pushed sharply higher in European trading on Tuesday with a high above 0.9350 and it sustained the advance in Asia on Wednesday as the Euro attempted to regain the 1.30 level against the Swiss currency.

The was an easing of risk aversion and a decline in oil prices which helped lessen defensive demand for the franc. Selling pressure is still likely to be limited by confidence in the domestic economy as seasonally-adjusted unemployment remained below 3.5% according to the latest data. Underlying confidence in the Euro-zone economy is also fragile which will maintain some defensive support for the Swiss currency.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

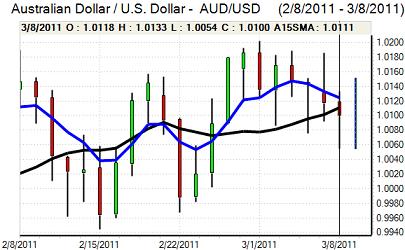

Australian dollar

The Australian dollar was blocked close to 1.0120 against the US currency during Tuesday and was subjected to renewed selling pressure during the European session with lows close to 1.0050. A recovery attempt was blocked close to 1.01 and there was renewed selling pressure in local trading on Wednesday.

The domestic data provided no support for the currency with a 4.5% decline in home-loan approvals according to the latest data and a weaker reading for consumer confidence which will maintain speculation over a slowdown in the economy.

The currency also found it difficult to gain support from a slight easing in risk aversion as there were still fears that the regional economy will slow.