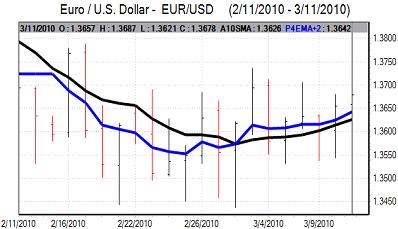

EUR/USD

The Euro found support above 1.36 against the dollar on Thursday and had a generally firmer tone, although it was unable to make strong headway as ranges were generally narrow.

Fears over the Euro-zone eased slightly, although there was still a high degree of caution, especially with strikes within Greece maintaining underlying fears over the budget outlook. French President Sarkozy toned down his rhetoric against a weak Euro and this also provided some degree of support for the currency.

US initial jobless claims fell to 462,000 in the latest week from a revised 468,000 the previous week which did not provide any strong evidence on economic trends. The retail sales and University of Michigan consumer confidence data will be watched on Friday for further evidence on the strength of consumer spending, although the impact may be measured unless the data is substantially worse than expected.

US Federal Reserve policy will be an important focus over the next week with the latest FOMC meeting due to be held on March 16.. There have been further comments from Fed officials suggesting unease with the terminology stating that interest rates will be left at very low levels for an extended period. In this environment, there is likely to be increased expectations of a change in the Fed’s language following next week’s meeting.

This speculation should provide some support to the dollar, although buying will be limited by doubts whether interest rates will actually be increased in the short term. The Euro pushed to a high near 1.3690 before consolidating around 1.3670 later in the US session.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

The yen regained some ground on Thursday as markets took a slightly more cautious tone. The latest Chinese consumer inflation data recorded an increase to a 16-month high of 2.7% which increased speculation that China would have to tighten monetary policy further in the near term to curb inflationary pressures and this curbed risk appetite.

In contrast, there was a downward revision to Japan’s fourth-quarter GDP data and weaker than expected figures on domestic demand increased speculation that the Bank of Japan would ease monetary policy at next week’s policy meeting. The dollar was holding just below 90.50 against the yen in early Europe.

The dollar reached a high just above 90.70, but the currency was unable to make strong headway and settled just above 90.50.

Sterling

Sterling found support below 1.4950 against the dollar during Thursday and was able to consolidate above 1.50 later in the day. There was some easing of selling pressure as there were no further negative developments on the economy.

Inflation expectations edged slightly stronger according to the latest Bank of England survey which may have provided some support for Sterling, although the impact is likely to be limited with market positioning a more important factor.

Underlying confidence in the economy and Sterling is still likely to be weak, especially as there is unlikely to be any easing of fears surrounding the government-debt situation. Sterling was able to hold above 1.50 against the dollar later in the session in the context of a wider dollar retreat and also edged stronger to 0.9080 against the Euro.

Swiss franc

The dollar was blocked below 1.0730 against the Swiss franc early on Thursday and was unable to make any renewed headway later in the US session.

As expected, the Swiss National Bank left interest rates at 0.25% following the latest policy meeting. The bank revised up its 2010 GDP growth and inflation forecasts slightly and was slightly more optimistic over economic trends with a warning that interest rates could not be left at very low levels forever given the inflation risks.

The bank also repeated the statement from previous meetings on the Swiss currency. It stated that it would aim to act decisively to counter excessive appreciation of the franc. The markets were not able to break Euro support levels as they took heed of the bank warnings, but the Euro was still trapped close to 1.46.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

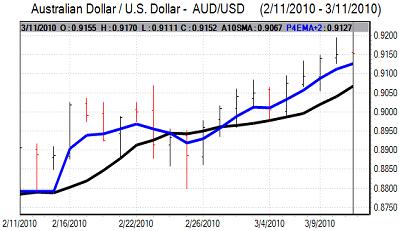

Australian dollar

The Australian employment data was weaker than expected with a marginal increase in employment for February. The Australian dollar weakened to near 0.91 against the US currency and there will also be fears that China will have to tighten monetary policy following the latest inflation data.

The Australian dollar dipped to lows near 0.91 against the US dollar before consolidating around the 0.9150 region as underlying sentiment was still firm.