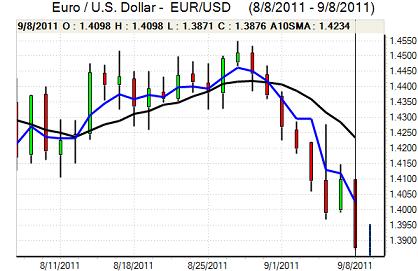

EUR/USD

The Euro held above 1.40 against the dollar ahead of the ECB interest rate decision on Thursday, but was blocked in the 1.41 area. As expected, the ECB left interest rates on hold at 1.50%. The ECB also presented fresh forecasts for the Euro area with modest downward revisions to growth and inflation estimates for 2011 and 2012 with the 2012 GDP range lowered to 1.3% from 1.7%. In the press conference, President Trichet stated that policy was still accommodate while there was a pledge to maintain all necessary liquidity support for the banking sector.

Trichet stated that the growth risks were now biased to the downside and there had been a significant change in ECB policy stance. Effectively, this meant that there would be no further interest rate increases with the bank moving to a neutral stance. Concerns over the growth outlook unsettled the Euro with lows below1.39 as markets priced in a fourth-quarter interest rate cut.

There were further fears surrounding the Euro-zone structural outlook as the Greek situation remained critical. There were further warnings from German and Dutch officials that Greece must meet the deficit-cutting targets in order to receive the next tranche of loan support. The Greek economy, however, contracted by over 7% in the year to the second quarter and there were increasing doubts whether Euro membership was viable.

The US jobless claims data was little changed at 414,000 from 412,000 previously, but there was a big improvement in the trade deficit to US$44.8bn for July. Exports were at record levels and will provide some support to the third-quarter GDP data.

President Obama’s pledge of a US$447bn jobs package did not have a significant impact while Fed Chairman Bernanke repeated that the Fed would explore options for further economic support at the forthcoming FOMC meeting. The Euro remained on the defensive near 1.39 in Asian trading on Friday.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

The dollar found support on dips to the 77.10 area on Thursday and rallied to the 77.55 area with trading ranges still relatively subdued. There was some dollar support from the latest trade data while Bernanke did not add to the dovish tone in his speech. Yield support for the US currency was still extremely weak which limited support.

The Japanese Finance Minister stated that the central bank was ready to take bold action on the currency and there was speculation over further independent or co-ordinated action to weaken the yen at the G7 meetings starting on Friday.

If there are no measures to weaken the yen, then there will still be the potential for defensive inflows into the Japanese currency, especially given fears over the Euro-zone outlook and lack of safe-haven candidates.

Sterling

Sterling found support close to 1.59 against the dollar ahead of Thursday’s Bank of England interest rate decision. Sterling initially gained support from Euro selling against Sterling and gained further support from the interest rate decision.

The MPC left interest rates on hold at 0.50% and the total amount of quantitative easing was also unchanged at GBP200bn. There was no statement with the policy decision. There had been some speculation that the bank would consider an increase in quantitative easing and Sterling rallied in relief that policy was unchanged.

There were still fears surrounding the UK economy given weakness in demand and there was selling pressure on moves to the 1.6050 area as international confidence in Sterling remained generally vulnerable. Sterling did advance to a two-week high against the Euro as Euro-zone confidence deteriorated.

Swiss franc

The dollar found support below 0.86 against the franc on Thursday and advanced strongly with a peak above the 0.8750 level before a slight retracement. The franc weakness was illustrated by the fact that if was unable to make any headway against the Euro.

There was further respect for the National Bank determination to prevent franc gains and there was additional speculation that the central bank was selling options to undermine the franc. Such a policy may be effective in the short term, but could destabilise the franc in the longer term. The franc also still gained some protection from fears surrounding the Euro-zone.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

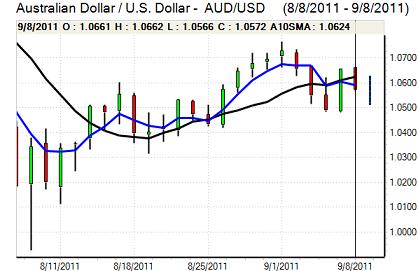

Australian dollar

The Australian dollar found support on dips towards the 1.0580 area against the US currency on Thursday while there was resistance above 1.0650. The currency was caught between optimism and pessimism which created an important element of caution as domestic and international uncertainty remained extremely high.

Fears surrounding the global growth outlook eased slightly and there was some support for the currency as a potential safe-haven. There were, however, also important reservations surrounding the domestic economy, especially given the housing-sector slide and risk conditions were also still very fragile.