EUR/USD

The Euro was unable to sustain a move above the 1.3280 area against the dollar on Tuesday and fluctuated in relatively narrow ranges during the day as markets continued to react to the Greek debt deal.

There was further relief that the immediate threat of Greek default has been eliminated. There were still uncertainties surrounding the private-sector restructuring deal and Greece announced that there would be a Collective Action Clause if the participation rate increased to above 66% which would force all bondholders to take part.

There were also fears surrounding the longer-term implications of the deal, especially as there are elections in April which is liable to trigger a fresh reassessment of the deal within Greece. In this context, there was very little confidence in the longer-term outlook which also dampened Euro support and risk appetite. There were also reports that the IMF will threaten to withdraw part of its support unless the EFSF and ESM support funds are strengthened.

There was relief in the Euro area as a whole and there was a further decline in Spanish and Italian yields which helped underpin sentiment. There was also some pressure to cover short speculative Euro positions, but the impact was still offset by an underlying lack of confidence in the Greek fundamentals.

There was a slight improvement in the latest Euro-zone consumer confidence release and the PMI data will be watched closely on Wednesday. Any further improvement in the indices would bolster optimism that recession pressures are starting to ease.

There were no major US developments during the day and there was still firm demand for Treasuries in the latest auction.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate* 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

The dollar was trapped within narrow ranges against the yen for much of Tuesday. There was support on any retreat to the 79.50 area while there was tough resistance on any move towards 80. Similarly, the Euro was blocked on any approach to the 106 region.

There was a slightly more cautious attitude towards risk appetite, especially with some unease that the Greek rescue deal did not attract a more favourable response. The Chinese PMI index was at a four-month high for February, but was still below the 50 level as exports orders fell.

Underlying yen sentiment remained weak as markets looked to sustain yen-selling momentum and there was a serious test of dollar resistance in the 80 region with a six-month peak close to 80.10 before momentum slowed.

Sterling

Sterling hit resistance above 1.5850 against the dollar during Tuesday and retreated steadily to lows below 1.5770 before finding some relief. There was a significant move on the crosses as the Euro advanced to the 0.84 area against the UK currency. Sterling was hampered to some extent by a more cautious tone towards risk appetite and there was also some disappointment that it was unable to break resistance levels.

The latest government borrowing data was again stronger than expected with a GBP10.7bn surplus for January which will continue to provide some degree of relief surrounding the immediate growth outlook and will have some impact in easing immediate fears of a debt downgrade.

The Bank of England MPC minutes will be watched closely on Wednesday. Given more favourable data releases and a less pessimistic stance from bank officials, it is possible that some members voted against an expansion of quantitative easing at the February meeting. If so, there would be some immediate benefit to Sterling, although the overall impact is likely to be limited as uncertainty remains extremely high.

Swiss franc

The dollar was unable to break above 0.9150 against the franc on Tuesday, but did find support on dips to the 0.91 area as ranges narrowed. The Euro was broadly unchanged in the 1.2075 region during the day. There was some relief that a Greek deal had been reached as this lessened the immediate threat of disruptive flows into the Swiss currency on safe-haven demand.

There was evidence of weaker exports in the latest trade data and this will maintain pressure for any franc gains to be resisted by the National Bank.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate* 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

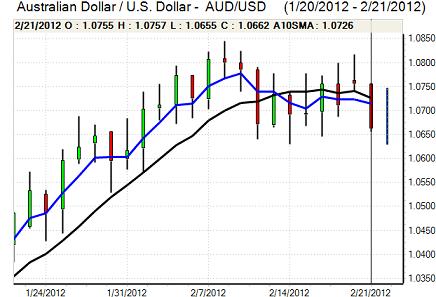

Australian dollar

The Australian dollar dipped sharply in the European session on Tuesday and after a rally attempt was blocked near 1.07, there was fresh selling pressure later in the US session with the currency briefly sliding to the 1.0620 area.

There was some residual negative impact from the Reserve Bank minutes and a more cautious tone towards risk appetite. There was also some evidence of longer-term selling pressure which dampened confidence. There was some relief surrounding the Chinese economic data with a rally back to the 1.0675 area as buyers looking to take advantage of recent losses.