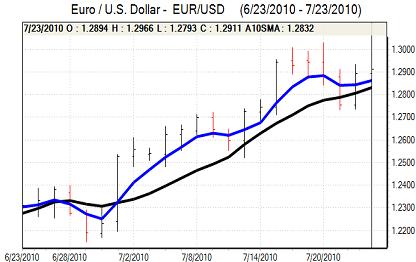

EUR/USD

The Euro drifted weaker in early Europe on Friday with a decline towards the 1.2860 area against the dollar. The Euro-zone data was again stronger than expected with the German IFO index securing the largest monthly increase for 4 years to 106.2 from 101.8 the previous month. Following the firmer than expected PMI data on Thursday, there was increased confidence in the economic outlook which also boosted Euro confidence and pushed the currency to a high above 1.2950.

The Euro was unable to sustain the advance and retreated back to the 1.29 area as uncertainty over the Euro-zone bank stresses tests discouraged fresh buying support. There were a series of media reports during the day and there were also fears that the methodology would not be robust enough to alleviate concerns over underlying financial health. As fears intensified, the Euro retreated to the 1.28 area ahead of the results.

There was also still some speculation that the Euro would be used as a global funding currency to invest in high-yield instruments which dampened demand for the currency to some extent.

There were no major US economic developments during the day as the Euro-zone trends continued to dominate.

In the event, 7 of the 91 banks were deemed to have failed the test with the main area of focus the Spanish savings banks. There was choppy trading following the results, but the Euro found further support close to the 1.28 region and strengthened to around 1.29 later in the New York session.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

There was further speculation during Friday that the Bank of Japan would intervene to curb yen appreciation and this continued to have a significant impact in limited yen support. Markets remained locked in relatively tight ranges in Asia on Friday with the yen also still generally resilient in the face of stronger equity markets.

There was a partial reversal in trends during the New York session with the yen being subjected to some selling pressure on the crosses, especially against Sterling. The dollar was also able to challenge levels above 87.25 against the Japanese currency as support levels held and there was a peak close to 87.50 later in the US session.

Sterling

Sterling held a slightly firmer tone in early Europe on Friday as risk appetite also held broadly firm and there were hopes for solid economic data.

In the events, the GDP data was much stronger than expected with a second-quarter increase of 1.1% compared with expectations of a 0.6% advance and this was the strongest figure for four years. There was a recovery in construction output following weather-related weakness during the previous quarter.

The data will still be important in boosting near-term confidence in the economy and will also trigger a renewed shift in interest rate expectations with renewed talk that the Bank of England could sanction a near-term increase in interest rates. Confidence could still reverse relatively quickly and there will also be concerns that the latest mortgage approvals data was weaker than expected which will maintain doubts over the housing sector.

Nevertheless, in response, Sterling pushed to a high around 1.5450 against the dollar and held a firm tone during the remainder of the session. The UK currency also strengthened sharply to highs around 0.8330 against the Euro.

Swiss franc

The dollar found solid support on dips towards the 1.0420 level on Friday and advanced to highs near 1.0560 later in the US session. Trends on the crosses remained important and a Euro recovery following the bank stress-test results helped limit demand for the Swiss currency.

There was also some reduction in defensive Swiss demand as confidence in global growth prospects improved. The near-term franc trends are likely to remain correlated significantly with degrees of optimism surrounding the global economy.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

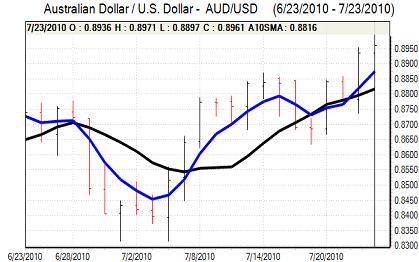

Australian dollar

There was a degree of market consolidation in Asia on Friday before fresh gains to 0.8950 against the US dollar. There was support close to the 0.89 level during European trading and the Australian dollar advanced to re-test weekly highs in New York.

The Australian dollar drew support from an improvement in risk appetite and gains in commodity prices as the latest European data also helped boost confidence in the global economy. The Chinese economy will continue to be watched closely in the near term and any signs of weakness would undermine the Australian currency.