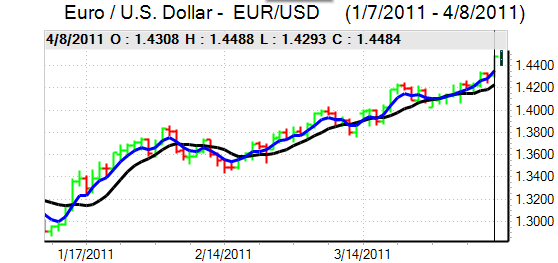

EUR/USD

The Euro found firm support close to 1.44 against the dollar during Friday and retained a strong tone as the US currency was unable to gain any traction. The US currency was again unsettled by reports of Asian central bank reserve diversification away from the dollar as reserves are swelled by intervention.

The US budget negotiations remained an important factor during the day as congressional negotiators and the Administration continued talks to avert a government shutdown. Despite a provisional agreement on spending levels, there was no agreement before the end of trading on Friday and this did have a negative impact on the dollar as markets continued to test US support levels with the Euro at a 16-month high.

The Federal Reserve policies will remain a very important focus during the forthcoming week as markets continue to assess potential policies following June. At this stage, markets are expecting the Fed to resist further quantitative easing, but also to maintain interest rates at extremely low levels. There are a succession of FOMC speeches due over the forthcoming week and markets will be looking at the tone closely. In comments over the weekend Fed Vice-Chairman Yellen stated that there was no case for tightening policy at present which continued to sap demand for the US currency.

ECB President Trichet declined to make further comments surrounding monetary policy during Friday, but there will be additional pressure on European Authorities to combat Euro strength, especially as a firm currency will make it even more difficult for the weaker peripheral economies to compete. Markets will also remain on high alert over the contagion threat within Europe, but the dollar remained on the defensive on Monday as a US budget deal failed to provide significant relief.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

The dollar was unable to make any impression on the 85.50 level against the yen during Friday and dipped to test support levels below 85 later in the US session. The US currency was vulnerable to profit taking following strong gains during the week as a whole.

There was further interest in carry trades which kept the Japanese currency under some pressure, especially with further market interest in gold and energy prices, but there was also some degree of caution with the yen over-sold on the crosses.

The Japanese core machinery orders data recorded a decline of 2.3% compared with expectations of a monthly increase, but the impact remained limited as there were expectations that data would be distorted by the earthquake impact. The dollar edged lower to the 84.70 area in Asian trading on Monday as corrective pressures continued.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

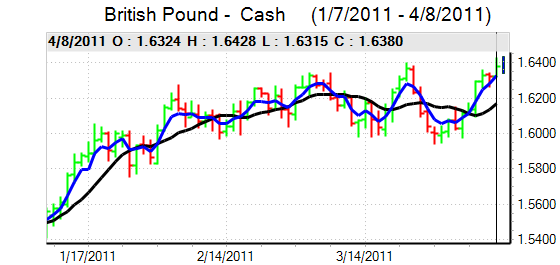

Sterling

Sterling pushed higher in European trading on Friday following a stronger than expected producer prices report as input prices recorded a further sharp 3.7% increase for March which maintained the annual increase at close to 15%.

The data reinforced market inflation fears and also increased pressure on the Bank of England to increase interest rates. The latest consumer inflation data will be watched closely on Tuesday and a further increase in the annual rate would increase pressure on the central bank.

In comments on Monday, MPC member Sentance maintained his stance that interest rates should be increase immediately by 0.50% to lessen the risk of more substantial rate increases later if inflation control is jeopardised.

The UK currency again hit selling pressure close to 1.64 against the dollar and dipped lower. Although it held comfortably above 1.63 as the US currency remained under general pressure, Sterling dipped to re-test support towards 0.8840 against the Euro.

Swiss franc

The dollar was unable to make any impression on the franc during Friday as it hit tough resistance above 0.9150 and it retreated to lows near 0.9060 late in the session, primarily due to wider selling pressure on the currency.

Despite a widening of short-term interest-rate differentials in the Euro’s favour, the franc was able to resist further selling pressure against the Euro with support on dips to the 1.3180 area.

Markets will remain on alert for comments from National Bank officials, although there is no scheduled policy meeting until June.

Australian dollar

After breaking above the 1.05 level against the US currency, the Australian dollar maintained a very strong tone on Friday and it advanced to fresh 29-year highs above 1.0570 in Asian trading on Monday.

There was further support from record gold prices in dollar terms while commodity prices in general also remained at extremely high levels. The Australian currency also drew support from expectations that Asian central banks would continue to diversify into the Australian currency. Markets will be on alert from comments by Reserve Bank officials who will be looking to counter excessive currency speculation.