Why are casinos so successful? The answer is because all of the games have a house edge, and the player is mathematically guaranteed to lose over the long run.

Sure you can walk in, win some money, and walk out ahead, but over time the casino always wins. If you’re not careful, trading can be no different! Without a clearly defined edge, traders are merely gamblers in a casino. Successful traders are the ones who have figured out how to find a consistent edge and transform themselves into the house.

TRADING GAPS

For many traders, including myself and my customers, that edge is some form of gap trading. Gap trading refers to the process of taking a position opposite the opening price gap. To illustrate, if the opening price (the price at 9:30 AM EST) is lower than the previous close (the price at 3:59 PM EST) then a gap trader may elect to take a long position, and if the opening price is higher than the previous close then a gap trader may elect to take a short position. In its purest form, a gap trade would seek a target of the previous close which is often referred to as a gap fill. Figure 1 below illustrates a gap fill trade in its most basic definition.

Figure 1 – Most Basic Gap Trade

So where is the gap trading advantage? If we look specifically at the ETF QQQ and the e-mini future NQ which both track the Nasdaq 100 index, roughly 70% of all their gaps fill during the same trading day. This is not an anomaly! The gap fill percentage is this high for many stocks, ETF’s, and e-mini futures. This represents a significant edge and an excellent starting point to build your trading strategy. From here, you can work in your own money management principles such as stop preferences and profit targets to build a profitable trading system.

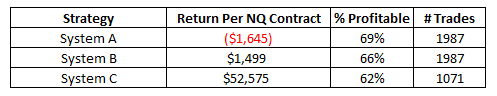

You may think you’ve just found the holy grail of trading, but not so fast! Is every gap trade a wise trade to make? Let’s take a look at some data to illustrate how gap trading is a good starting point for strategy development, and why you probably shouldn’t trade every gap. Table 1 below shows you the theoretical results of two systems with the following underlying rules. System A trades every gap that is a minimum size of +/- 0.1% and exits when the gap fills or at the end of the day (3:59 PM EST). System B is the same as System A but it also incorporates a 1% stop loss. System C is the Gaps to Riches optimized model and it trades based on an extended set of rules to further sharpen the trader’s edge. These proprietary extended rules provide for more stringent entry criteria based upon where the gap opens relative to key price points which have occurred over the previous trading days.

Each system was tested over the same 10 year period covering 11/2003 to 11/2013. Additionally, the Gaps to Riches model utilizes varying profit targets that are either a fraction of or beyond the gap fill. The size of these targets are determined by looking at the different categories of gaps that I have defined and seeing how each has historically performed. Click here for an expanded version of Table 1 which includes some additional data.

Table 1- Comparison of Gap Trading Systems

While the exact details of the Gaps to Riches model are proprietary, any trader can start with the basic gap fill model that we have described above in System B and then do some further grouping of gaps to identify those gaps that perform well and those that perform poorly. There is no right or wrong way to group them, and many traders will find that they can improve upon the results of System B if they spend some time on it.

Whatever trading methodology you decide to adopt, first find your edge and develop your trading plan to avoid gambling away your money in the markets.

= = =

Like TraderPlanet on Facebook. We’d love to hear from you.