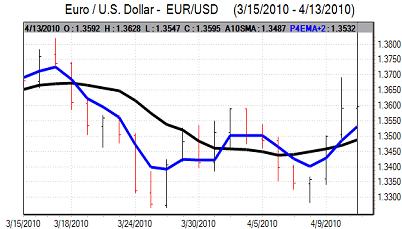

EUR/USD

The Euro nudged lower in Asian trading on Tuesday as underlying confidence remained weak and there were tensions ahead of the Greek bond auction. There was significant support above the 1.3550 level as there was a reluctance to sell the currency aggressively given the potential for a further squeeze on short positions.

There was firm demand in the Greek auction which provided relief, but underlying confidence in the Euro and Euro-zone economy remained weak. There were concerns that underlying pressures to curb deficits would trigger renewed downward pressure on growth which would damage underlying confidence and also risk political stresses.

There were also fears that market tensions would spread to Spain and Italy while there was some opposition to the support measures within Germany which unsettled confidence.

The US trade deficit widened to US$39.7bn for February from US$37.0bn the previous month while consumer confidence recovered according to the latest data. The overall impact was still limited with markets focused elsewhere. There will be optimism over the retail sales data due on Wednesday and the dollar should continue to gain some support on yield grounds over the next few days. Markets will watch comments from Fed Chairman Bernanke during Wednesday for any hints over the timing of monetary-policy tightening.

The Euro again dipped to lows just below 1.3550 before finding support and consolidated around the 1.36 level in US trading as underlying dollar demand was still subdued.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

There was a further mood of caution in Asian trading on Tuesday as equity markets edged lower while there were also some fears over the underlying outlook for G7 growth as debt fears remain an important underlying influence. Demand for the yen is still liable to be stifled by a lack of yield support as yen Libor rates remain below equivalent US rates.

There has been a sharp increase in short yen positions over the past few weeks and there has been some reluctance to sell the yen further while there has also been some evidence of existing positions being scaled back. In this environment, the yen gained support on Tuesday and strengthened to neat 92.60 against the US dollar.

The dollar moved back to above 93 later in the US session as there was solid dollar buying support on dips while the yen moved from its best levels.

Sterling

The UK growth-orientated economic data was mixed with the BRC retail sales report recording growth of 4.4% in the year to March, although this may have been distorted by the timing of Easter. The RICS house-price index halved to 9 for April which will increase speculation that price rises will stall this year.

The trade data was better than expected with a sharp decline in the deficit to GBP6.2bn for February from GBP8.1bn the previous month. There was a sharp recovery in exports following a decline in January when shipments had been undermined by poor weather conditions.

There was still underlying caution over the government-debt position, especially with some concerns that there would be a renewed market focus on the UK as attention on Greece eased slightly.

Swiss franc

The dollar pushed to a high close to 1.06 against the franc on Tuesday, but was unable to sustain the advance and dipped back towards the 1.0550 level. The dollar was hampered by general franc strength on the crosses with a Euro decline to the 1.4330 region in US trading.

Underling confidence in the Euro-zone area remains weak which will continue to limit selling pressure on the Swiss currency. If the Euro loses further ground, there will be a renewed focus on the National Band as pressure for intervention would return.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Australian dollar

The Australian dollar found support close to 0.9220 against the US dollar on Tuesday before moving back towards the 0.9265 level. As the US currency came under some selling pressure, the Australian currency edged higher to the 0.9285 region.

Underlying confidence in the Australian economy should remain firm, but the underlying tone is still likely to be more cautious, especially with doubts over the global economic trends and the Chinese policy response.