Cisco Systems. The name brings to my mind two things; SISQO, the singer with the stellar one hit wonder and the cooking oil Crisco. In reality, Cisco is a worldwide leader in networking and connects people internationally so they can communicate more effectively.

A LITTLE BACKGROUND

CSCO is a huge company and is included in the Dow Jones Industrial average, S&P 500, Russell 1000 index and the Nasdaq 100. Since March 29, 2011, Cisco has started paying dividends. CSCO is a lower priced stock and great for beginning investors or investors with a smaller portfolio. Puts can be sold on this stock to leg into actually owning the shares. CSCO also pays fairly decent covered call premiums. For example, if one owned the stock right now, a $22.00 covered call could be sold, expiring in March, bringing in .26 cents. That is the equivalent of two dividend payments.

THE STRATEGY

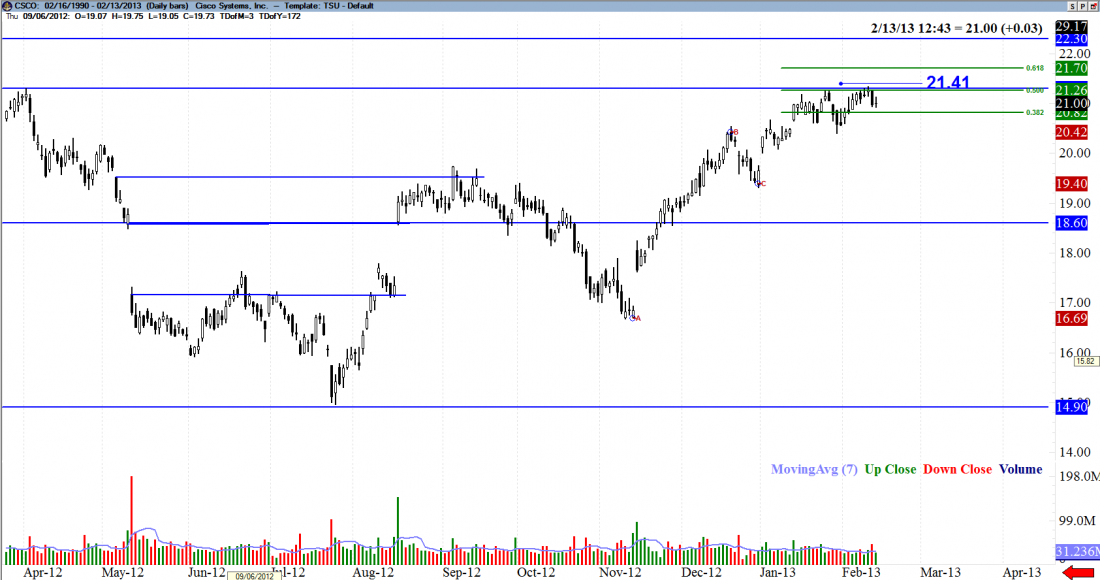

One could add to their overall positions if the stock closed above $21.41. A large gap occurred almost exactly two years ago. This is going to prove to be a strong resistance. That is why this could very well be an exceptional location for the selling of covered calls, especially if your initial purchase price for your shares was less than $22.00

I used an advanced targeting method, called Fibonacci to determine potential targets. $21.70 would be the first potential target, then resistance at $22.30. You could consider a bearish trade with a close below $20.32 getting below the candle wick on 01/30/2013. Whatever image conjures in your head when you see Cisco, this could be a fun trade!