When done properly, options can be an important part of a trader’s portfolio, hedging risk and giving traders the power of leverage.

However, these are not lottery tickets. At its most basic level, option prices are the same as equity and other market prices – in that they are priced low for a reason, meaning the likelihood of them expiring with any value is low.

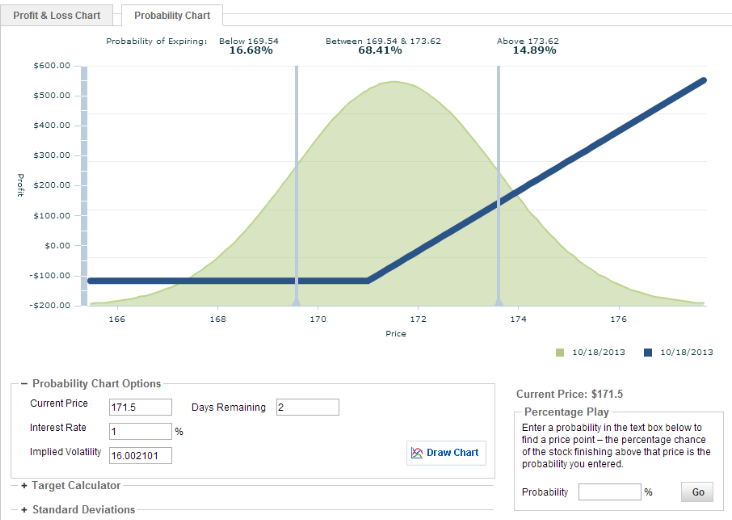

So, if you are thinking about trading options, the first thing you need to do is make sure you know the odds. These are easy – as most platforms and brokerages provide charting tools that can plot out a standard probability and P&L chart (example below).

This particular one (taken on Wednesday) focuses on a two-day $171 SPY call – when SPY was trading at $171.50. On the X-axis are the strike points, while the Y-axis is the P&L, which is denoted with the blue line. Without paying too much attention to the numbers (since they will change depending on the option and current price), these charts are important for the green shaded area, which gives probabilities using a standard bell curve. From this chart, one can see which expirations might be more or less likely – and how that will impact P&L.

For example, since there is a roughly 50 percent likelihood of the price being above the $172 breakeven price at expiration. Inherently, this should make sense since the option is termed at-the-market. For an out-of-the-money option, the chart would skew so that there is a lesser likelihood of breaking even.

Now that you know the odds, here are five reminders that will help the rest of your options trading.

1. You can be right – but wrong. The first thing you should know about options is that you can be right about the asset, but ultimately wrong. An option is priced on a few main factors: (1) the strike price – specifically its relation to the current market price; (2) volatility of the underlying asset; and (3) time until the option expires. (Other things like dividends and interest rates are also considered but typically play a less important role.)

In order to make a good trade, you have to think about the asset in that context. You could be right about the direction of the stock, but wrong about the timing or the strike price. Either of those factors would make you wrong overall.

2. All options have an expiration date. Buying an option means you have the right, but not the obligation, to buy a security at a certain price and on or before a certain point in the future.

For traders, this means that your trade is already on the clock. You cannot “buy and hold” options – or at least you can, just not past the expiration date. That’s when you have the decision to make: do I buy (sell) the security or do I sell my option – both of which you can only do if the strike price is below (above) the current price of the security for a call (put).

3. If you are short an option, you can have stock assigned to you. If you sell an option, you are obligated to either buy (in a put) or sell (call) the stock at the strike price. Of course, you will only be forced to buy or sell the stock if the price has moved against you – so this creates the potential for losses to mount.

Say, you sell an at-the-money AAPL put with a $500 strike price for December. That may yield you $23 (price as of Wednesday). You will make a profit on this trade so long as AAPL trades above $477 on December expiration. But, even if the price is $1 below $500, you will have to buy that position.

4. Position sizing is critical. In trading equities, position sizing is extremely important. In options, it is critical. That’s because options allow you the ability to leverage. In the above example that translates to the ability to have the same purchase power of 100 shares of AAPL for $2,300 (instead of $50,000).

But, one of the benefits of options is that buying an option (or even using spreads) defines your risk to complete certainty. Such definition is not certain in pure equity trades – where earnings reports and adverse news can push prices above or below your stop orders.

At Tradespoon, we recommend that risks from options trades comprise no more than 5 percent of a portfolio. Because of the way we structure our trade recommendations, these typically offer at least a 1:1 risk/reward ratio – meaning they could add 5 percent gains to a portfolio.

5. All other factors constant, options will decline in price as time progresses. Of these, if volatility and market price remain constant, it is important to note that the option value will decline as time progresses. On a basic level, this should make sense: time = uncertainty and the more uncertainty the higher the price.

The bottom line – options are worth the time to learn about, as they can add steady returns to a portfolio. However, you shouldn’t think that you could translate equity market success into options trades; it is more complex than that.