I want to tell you about the Butterfly, one of my very favorite low-risk, high-reward, directional-option strategies.

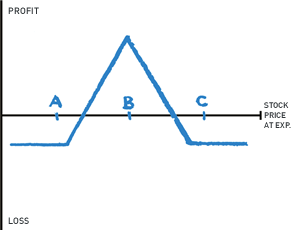

The strategy is long strike A one time, short strike B twice and long strike C once. The strategy is all puts or all calls. As you can see, you can look at it as a combination of two vertical spreads, one long and one short. You want the long vertical to expire at maximum value and the short vertical to go out worthless – expiration exactly at strike B, in other words. Your risk is limited to the debit paid.

It is important that all strikes be equidistant from each other. My rule of thumb is never to pay more than 10% of the strike interval. So, $1 in a 10 point ‘fly, $.50 in a 5 point ‘fly, etc. This gives us a very nice 1:9 risk/reward ratio.

To be able to do this all parts of the ’fly will be out of the money, making it a directional trade, albeit an inexpensive one.

Let’s look at a real time example (March 10, 9:30 CDT) using Apple (AAPL).

(chart courtesy of Yahoo Finance)

Let’s say I think AAPL (now trading at 126.15) truly peaked and will head to 110 by July.

I can buy the July 100 put one time for 1. I then sell the July 110 put twice at 2.60 and buy the July 120 put one time at 5.20. This means I have paid a 1 point debit for this 10 point butterfly, exactly at my 10% of the strike interval guideline. This 1 point (or $100 per butterfly) is also the most I can lose where ever AAPL expires in July. An expiration at 110 makes me exactly 9, or $900. This gives me the 1:9 risk reward ratio I am looking for.

Moreover, as AAPL approaches my 110 target, the butterfly will widen. One of my basic trading rules is to always take off half a position when doing so lets the other half run for free. In trader’s parlance, we call this “taking a double.” It is simply good risk management. So, if I have the ‘fly on 10 times and it widens to 2, I sell 5 and let the other 5 run. Hey, why not play with the house’s money?

In fact, if I think a stock will be super volatile I can put on two butterflies, one call and one put. As soon as one moves enough to pay for the other I take it off and let the other one run.

What if AAPL isn’t going 110 but will hit 140 in July? Using today’s prices, I can buy the July 130 call once at 6.25, sell the 140 call twice at 3.25, and buy the 150 call once at 1.25. This means I risk 1 to make 9, just as in the put butterfly.

Hey, if AAPL does turn super volatile both ‘flys could double by expiration. Unlikely, I admit, but stranger things have happened.

In any case, I hope that I have shown what a simple, low risk, directional play a butterfly can be. So, open that chrysalis and let the butterflies fly!

#####

If you would like to get more from Randall Liss and The Liss Report, please click here.