EUR/USD

The Euro found support on dips to the 1.31 area in Europe on Tuesday and, after a spell of range trading, there was a renewed push higher in New York trading. A sharp decline in German industrial production did not have a sustained market impact.

There was a continuing focus on Greek debt negotiations during the day and there were reports that the coalition parties had agreed on a framework for reforms. There was, however, no formal agreement and no press announcement while a Euro-group meeting had also not been confirmed. There were also reports that the ECB would be willing to exchange its Greek debt holdings with the EFSF which boosted sentiment. There were also comments from several officials that the Euro would be able to survive without Greece in the single currency and there will still be speculation that reduced fear surrounding the consequences of a Greek exit will encourage negotiators to take a tough stance.

The US economic indicators were relatively minor, but maintained a firm tone as consumer credit rose by a further US$19.8bn in the latest month while there was also a stronger reading for consumer confidence. Although this suggests solid growth, the data impact was limited and tended to be overshadowed by comments from Fed Chairman Bernanke. His remarks were broadly unchanged from last week with no concession to the payroll data as he stated that the data was understating the unemployment problem.

The comments reinforced expectations of a dovish tone which further undermined any yield support. The Euro gained further backing from a covering of short positions and pushed to highs above 1.3250 before consolidating and then advancing again in Asia on Wednesday.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate* 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

The dollar found support in the 76.50 area against the yen on Tuesday and pushed steadily higher during the day even though it was generally weaker against major currencies. The US currency was also firm even with a lack of additional yield support.

Risk appetite was generally firm which helped curb demand for the Japanese currency during the day. The admission earlier that the Bank of Japan had intervened in the market during the fourth quarter without making an official announcement also had a significant impact with concerns that the policy would be repeated and this certainly increased wariness over buying the Japanese currency.

The current account remained in surplus for January on a seasonally-adjusted basis while bank lending rose 0.6% for the month. There was little impact from the data with the dollar testing resistance above 77 in Asia on Wednesday.

Sterling

Sterling gained some support from a net improvement in risk appetite during Tuesday as it pushed to a 12-week high against the US currency. The net impact will tend to be mixed, however, as any reduction in fear surrounding the Euro-zone would tend to erode defensive support for the US currency.

The latest BRC shop-price inflation index slowed to 1.4% in the year to December which will maintain hopes that underlying inflationary pressure is easing which would also give the Bank of England increased scope for monetary easing if required.

The Monetary Policy Committee will start their meeting on Wednesday with a decision due to be announced on Thursday. There has been a persistent scaling back of expectations surrounding additional quantitative easing this month which has provided some Sterling support.

Swiss franc

The dollar was unable to hold above 0.92 against the franc on Tuesday and dipped sharply to lows near 0.9115 even though the currency was cushioned slightly by renewed Euro gains against the Swiss currency as it tested resistance above 1.21.

Interim National Bank Chairman Jordan repeated that the bank would resist forcefully any attempt to strengthen the franc and that gains beyond 1.20 would not be tolerated. The rhetoric was broadly in line with recent comments from bank officials, but there were also some hints that more aggressive action might be taken in the form of negative interest rates and this did have an impact with some closing of long franc positions.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate* 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

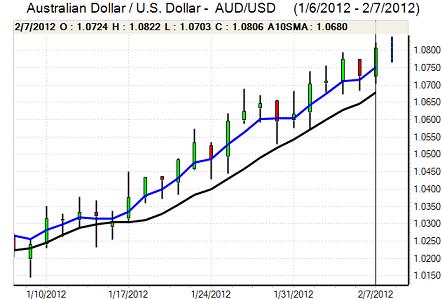

Australian dollar

After strong gains following the Reserve Bank interest rate decision, the Australian currency held the bulk of the advance even though there was selling pressure above the 1.08 level.

Risk appetite remained stronger which helped underpin the Australian currency and there were renewed gains during the Asian session on Wednesday as the US currency remained on the defensive.

There was further yield support following the Reserve Bank decision which will maintain potential interest in the currency on carry-trade grounds, especially with US Fed Chairman Bernanke highlighting his concerns over unemployment.