With some statistics claiming that 75% of all options expire worthless, we are all aware that buying options is a very risky game. But what if you could greatly increase your chances of picking the options that double, triple, or even quadruple in value, would you be more willing to take a bet on these options?

- The Size of the Block Traded – is the option contract trading 10 contracts at a time or did a large amount get filled all at once? Many small blocks being filled could indicate a popular newsletter covered this stock or even particular option contract, but a large block all being filled at once, or what I call “someone knows something volume” could indicate a large institution or hedge fund has turned bullish on the stock, or even better… That someone really may know something.

- The Price the Large Block Was Filled – Was the large block filled at the bid, mid, or ask price? If it was all filled at the asking price, we can assume someone is very bullish (in the case of a call option contract) or very bearish (in the case of a put option contract). If it was filled entirely at the bid price, we can assume that someone is very bullish (in the case of a put option) or someone is very bearish (in the case of a call option). Mid point fills do not signal great conviction, therefore I tend to stay away from them for the time being, however I note the contract and monitor it over the next couple of weeks.

- The Underlying Stock’s Price Action – Was the stock upgraded/downgraded that morning or did some very bullish/bearish news come out? Is the stock breaking to the upside/downside based on technicals? is the volume surging compared to the daily average? Although it is a very good idea to trade options based on news and technicals, I will be avoiding as much news and technical information for this alert service. The reason being: if there happens to be a rumor circulating that company WXYZ is likely to get acquired, the stock will most likely trade higher as a result of the rumor causing option prices to follow, not to mention option volatility is likely to increase causing the option to become even more overvalued. In the days following the rumor, the stock may settle back down and option volatility will come in causing option premiums to collapse and traders/investor to lose money. Therefore I look for option contracts which trade heavily compared to the open interest, without any significant news and slight price and volatility increase.

We can see on February 25 that 5,106 HSNI June 2010 $30 call options traded on an open interest of just 6! Over 5,000 of these contracts traded all at once going for the ask price of $70 per contract. This option activity struck me as “someone knows something volume” therefore I followed the money and purchased these calls. In the month following this very bullish option trade, we can see that shares of HSNI increased by 38.97% and these call options have increased by over 470%!

We can see on February 25 that 5,106 HSNI June 2010 $30 call options traded on an open interest of just 6! Over 5,000 of these contracts traded all at once going for the ask price of $70 per contract. This option activity struck me as “someone knows something volume” therefore I followed the money and purchased these calls. In the month following this very bullish option trade, we can see that shares of HSNI increased by 38.97% and these call options have increased by over 470%!

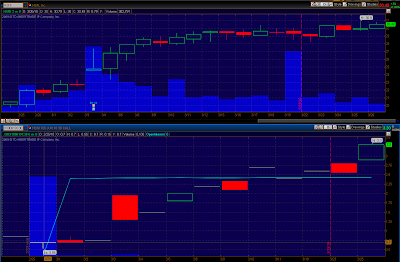

We can see on March 8 that 2,001 FINL August 2010 $15 call options traded on an open interest of just 24! 2,000 of these contracts traded all at once going for the ask price of $80 per contract. Again this option activity signaled “someone knows something volume” and I would have sent an alert out as soon as I noticed this. In the three weeks following this very bullish option trade, we can see that shares of FINL increased by 27.77% and these call options have increased by over 330%! You can also see on March 26 that 2,008 of these contracts traded on open interest of 2,030. High volume again, however contracts were being closed. This would have been my signal to take profits or roll the contract to a different strike price.

We can see on March 8 that 2,001 FINL August 2010 $15 call options traded on an open interest of just 24! 2,000 of these contracts traded all at once going for the ask price of $80 per contract. Again this option activity signaled “someone knows something volume” and I would have sent an alert out as soon as I noticed this. In the three weeks following this very bullish option trade, we can see that shares of FINL increased by 27.77% and these call options have increased by over 330%! You can also see on March 26 that 2,008 of these contracts traded on open interest of 2,030. High volume again, however contracts were being closed. This would have been my signal to take profits or roll the contract to a different strike price.

Detail:

Price:

![]()

![]()

Disclaimer: It is extremely important to remember that this is an extremely aggressive and speculative investment strategy and 100% of the money paid for any option contract could be lost. It is very important to risk only what you can afford and are willing to lose in any investment. The ideas presented in my alert service are solely for informational purpose only, and are not intended to provide any recommendation to buy or sell a security or to provide investment advice. I am not responsible for any losses or damages whatsoever that may be arising from any use of the content of Follow the Maestro’s Follow the Money Alert Service. You are solely responsible for your trading outcomes or for any losses, monetary or others, which may be resulting from the use of the content of Follow the Maestro’s Follow the Money Alert Service. You must do your own due diligence before committing any investment. Stocks and options involve risk so always be sure to use caution when buying or selling any type of security! To read the risks involved with options please view the Options Clearing Characteristics and Risks of Standardized Options Here.