As an active trader I have a single barometer to measure my success–real profit. Real profit is what you spend when you take your spouse to dinner. Real profit is what you spend on your family vacation.

Real profit should never be confused with unrealized gains. “Unrealized gains” or “unrealized losses” are theoretical profits or losses that you are currently holding in your open trades. If you agree, let’s explore together the four ways we can increase our profitability. I call these the “four levers of profitability.” Making minor adjustments in each of these areas will have massive results on your bottom line or profitability.

PULL THE LEVERS

As we begin, here is a quick story that will help bring clarity to the principles that follow. My wife and I are blessed with four children and two of them are boys. We recently went to a little festival where they had real, full-size, John Deere green, honest-to-goodness “diggers.” (You may know them by their more common name backhoes”). The operator invited my boys to join him in the cab and wreak havoc on some dirt. Naturally, the boys began pulling every lever to see what they would do. Finally, as the operator taught them what each control did, they were able to pull the individual levers and experience the desired result – in this case a massive hole in the ground.

TRADING CHOICES

Trading is the same way. There are only four “levers” that we can pull to increase profitability. That’s it–four controls are all that impact our single objective to create spendable profit.

LEVER ONE: BOOST NUMBER OF WINNERS

Increase the number of winning trades or your win/loss ratio. The win/loss ratio is often the primary metric for beginning traders. Beginners are easy to spot because when I meet them they are quick to share this metric. It’s almost like a badge. While indeed this is an important metric, let’s not lose sight of the fact that you can trade accurately 99% of the time but still lose everything on the 1% that you’re wrong. Is your win/loss ratio an important element to track? Absolutely. Just don’t be deceived, it’s only 25% of the controls that impact our bottom line profit.

LEVER TWO: INCREASE PROFIT

Increase profit on winning trades, or your return on investment (ROI). Increasing profitability on your winning trades is one of the main marks of a professional trader. Be sure to understand the magnitude of this lever. I’m not suggesting you try to eke out a couple extra points on individual trades. That’s reckless trading. Rather, use solid analysis principles and limit yourself to entering only those trades that have outstanding reward potential. You don’t increase ROI by trading through your targets, but rather finding trades that have exceptional targets to begin with.

LEVER THREE: MINIMIZE LOSSES

Decrease your losses on losing trades, or the all-important risk management. Managing risk appropriately is another mark of a professional. Read the biography of any investor or active trader and a singular theme is evident: those who are most profitable manage risk most effectively. This third lever is another form of ROI; it’s actually managing your negative return on investment. Similarly to the second lever, decreasing your losses come by entering trades that have limited risk potential. Effective use of stops and hedging strategies are also critical to managing risk.

LEVER FOUR: DECREASE OVERHEAD

Decrease your overhead and that includes commissions and taxes. The fourth lever of profitability is often overlooked by active traders. Commissions and taxes are the only two operating expenses in the business of trading, and as such should be consistently tracked. Commissions in particular can often skyrocket when an individual is over-trading. Obviously, if it takes 20 trades to make $5,000 instead of two, the spendable profit is going to be greatly reduced.

TIME TO TWEAK

When I teach these principles to my students, typically they think massive adjustments are necessary to experience the type of profitability they desire. You may even be thinking right now that you need to make 10 or 15% adjustments, but most likely you don’t. What if I asked you to commit to 5% or less in each of these four areas?

THE NUMBERS

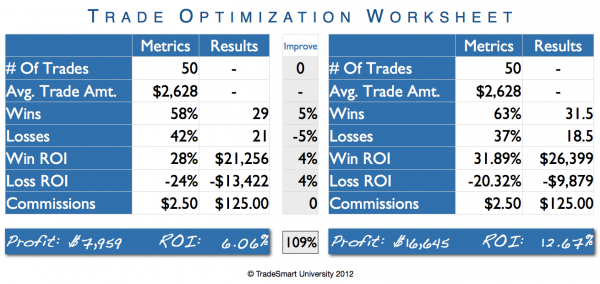

Below is an example of a real student I worked with recently but for privacy sake let’s call him Brian. I use this example because I believe it’s fairly relatable to most people. Here are Brian’s metrics over the last three months of trading.

o Number of trades – 50

o Average trade amount – $2,628

o Number of wins – 29 (58%)

o Number of losses 21 (42%)

o Winning ROI – 28% ($21,256)

o Losing ROI – 24% ($13,422)

o Commissions $2.50/trade ($125)

Brian’s total profit from the last quarter was $7,959 and his ROI was 6.06% – certainly a respectable performance over the last three months. In this particular session I worked with Brian to create a trading plan that would improve the metrics in each of the four areas we just discussed and asked him to commit to a reasonable, no nonsense result he thought he could achieve in each area. Like most students he wanted to improve about 10% across the board. Although I thought this was reasonable, I still cut each of his goals in half and reminded him this needed to be a completely attainable goal. The following graphic demonstrates his result.

As you can see, by making 4% and 5% changes, Brian was able to more than double his ROI and his profits. What’s interesting is, in this particular example, Brian didn’t even need to make a change to his overhead (the fourth lever). At $2.50 a trade and placing 50 trades a quarter he was happy with this metric and chose instead to concentrate on the other three levers of profitability. (I do need to mention that the optimization worksheet does make an assumption that the positions you enter are of similar value.)

FOCUS ON PROFITS

Successful traders are constantly tracking and working to improve each of these four metrics. Remember, “Where your focus goes, profit flows.” Choose to focus on the real results of these four levers and leave the unrealized gains for the other guys to focus on.