EUR/USD

The Euro initially maintained a firm tone on Friday with a further decline in peripheral bond yields helping to underpin sentiment while there was pressure to curb short positions ahead of the weekend. After a strong Spanish bond auction, the latest Italian sale was slightly disappointing in terms of investor demand and there were still record amounts held on deposit at the ECB which hurt sentiment.

The Euro was then subjected to heavy selling pressure during the New York session as rumours built of a Standard & Poor’s French sovereign-rating downgrade. The market has been unsettled by rumours many times over the past few weeks, but this time the reports were accurate. The French rating was cut by one notch to AA+ with a negative rating and Austria also lost its AAA rating. There was some relief that there had only been a one-notch downgrade, but there were still important negative implications as it would make it more difficult for reserve managers to hold French debt. There were also further fears surrounding the EFSF rating.

Negotiations between the Greek government and international bond-holders on a voluntary write-down on Greek debt also collapsed during Friday. Negotiations are due to resume on Wednesday and there were increased fears of a hard Greek default. There were further negative comments surrounding the Greek situation from within Germany with the head of Linde calling for Germany to leave the Euro area.

The November US trade deficit increased to the highest level since June at US$47.8bn from US$43.3bn previously as import demand increased while the University of Michigan consumer confidence index rose to 74.4 from 69.9 previously. Although the impact was overshadowed by Euro-zone developments, markets will remain on high alert for comments from Federal Reserve members ahead of the first 2012 FOMC meeting next week.

The Euro remained under heavy selling pressure and dipped to fresh 16-month lows near 1.2620 before staging a slight corrective recovery. The number of speculative short positions increased to a fresh record high according to the latest IMM data.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate* 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

The dollar found support in the 76.70 area against the yen during Friday and pushed to test resistance levels above 77, although it was unable to sustain the gains. Dollar/yen movements were limited as markets were dominated by moves on the crosses. The Euro came under fresh selling pressure and tested 11-year lows near 97.0

There was a recovery in machinery orders for the first time in three months with a much stronger than expected 14.8% increase following a 6.9% decline previously which may provide some reassurance surrounding the Japanese economy.

The ratings downgrades for Euro-zone sovereign nations will make it more difficult for Japan to hold European bonds and there will be the continuing threat of capital repatriation which will provide some underlying yen support.

Sterling

Sterling was unable to regain the 1.54 level against the US dollar during Friday and was subjected to heavy selling pressure during the New York session with a test of support below 1.5280.

The latest producer prices data was weaker than expected with a decline in input prices to the lowest level for 18 months. Markets will be expecting a sharp decline in the consumer inflation rate on Tuesday which will reinforce market expectations that the Bank of England will move towards additional quantitative easing.

The latest Rightmove house-price index registered a decline of 0.8% for December after a 2.7% fall previously, maintaining expectations of underlying weakness which will tend to undermine consumer spending. There was some evidence of fresh defensive demand for Sterling given the Euro-zone ratings cuts and the UK currency advanced back to near 0.8250 against the Euro.

Swiss franc

The dollar found support on dips towards 0.94 against the franc on Friday and advanced strongly to a high above 0.9550 during the New York session. The Euro cross remained under close scrutiny as the Swiss currency strengthened to highs beyond 1.2070 as the Euro lost underlying support.

The proximity of the 1.20 Euro minimum level will be important with strong pressure on the National Bank to take action and prevent the risk of any serious attack on the barrier. Volatility will be an important threat over the next few days at least.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate* 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

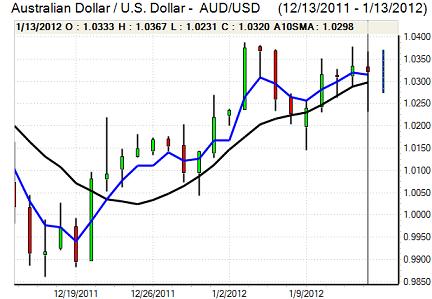

Australian dollar

The Australian dollar stalled just above 1.0350 against the US dollar on Friday and retreated sharply to lows below 1.0250 before finding some support. The currency was broadly resilient as a net improvement in risk conditions has lessened the risk of sustained Australian dollar selling when the Euro is subjected to losses.

The latest housing data was slightly stronger than expected with a 1.4% increase in home loans, although the potential impact was offset by a decline in job adverts. There was also underlying caution surrounding the Asian economic outlook with the latest Chinese GDP data due on Tuesday.