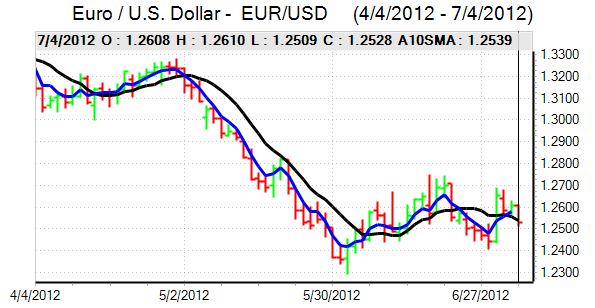

EUR/USD

The Euro found support on dips towards 1.2650 against the dollar on Tuesday while there was resistance above 1.2620 as caution prevailed and trading volumes declined.

There was a further measured decline in Spanish bond yields which provided some degree of support for the Euro. There was, however, further tensions surrounding proposals to support the Spanish banking sector through the ESM. The Spanish government pointedly stated that a few countries could not block an ESM deal in reference to the Finnish and Dutch opposition to secondary-market purchases.

There were also further tensions within Germany as the Bavarian CSU Party threatened to pull out of the coalition wit Chancellor Merkel’s CDU Party which would deny the government a majority. There was still an underlying lack of confidence in the banking sector which had a negative impact on sentiment.

On economic grounds, there were fresh concerns surrounding the French budget deficit with a projected financing gap of EUR6-10bn in 2012 and over EUR30bn in 2013. There was also further speculation that the ECB would cut interest rates to fresh record lows at Thursday’s council meeting. Although a cut in rates would have a negative impact on yields and could push portfolio funds out of the Euro, there was also some optimism that it could spark a recovery in risk conditions and spur hopes for a recovery.

There were no major US developments during the day as New York trading slowed sharply ahead of the Independence day holiday. The US currency was hampered by an overall improvement in risk conditions as well as expectations that the Federal Reserve could move towards additional quantitative easing. The Euro edged back to the 1.26 region later in the US session where resistance levels remained tough.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate* 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

The dollar was able to resist selling pressure during the European session on Tuesday and pushed to a high around 79.90, but there was no serious challenge on the 80 level. The dollar struggled to find any momentum with US bond yields still at low levels.

There was further evidence of exporter selling close to the 80 level during the Asian session on Wednesday which put some degree of selling pressure on the US currency. There was also some evidence of Euro selling in the context of bond redemptions which underpinned the yen. Underlying risk conditions were, however, still generally more favourable which had a significant impact in curbing immediate defensive demand for the yen.

Sterling

Sterling continued to hit resistance above 1.57 against the dollar on Tuesday while there was support on dips towards 1.5650 with Sterling unable to break through the 0.80 level against the Euro.

The UK construction PMI index dipped sharply to 48.2 for June which was the lowest figure since the first quarter of 2010. With the manufacturing sector also below the 50 level, confidence will dip sharply if there is also a sharp decline in the services sector on Wednesday.

Any sharp decline in all three sectors would certainly increase pressure for the Bank of England to boost quantitative easing, especially as the latest money-supply data also remained weak. The latest BRC shop-price index also declined to 1.1% from 1.5% previously which was a three-year low and illustrated a lack of inflation pressure.

The UK currency is still proving to be broadly resilient in the face of weak fundamentals. The latest data also stated that foreigners were net sellers of bonds during May for the fifth successive month which will cast some doubt on safe-haven demand for the currency. Sterling consolidated below 1.57 against the dollar in Asia on Wednesday.

Swiss franc

The dollar hit resistance above 0.9550 against the franc on Tuesday and retreated to the 0.9520 region in subdued trading conditions as the Euro was unable to make any impression on the Swiss currency.

There has been further speculation that the Euro minimum level will come under intense pressure and eventually break if stresses within the Euro-zone intensify. An ECB interest-rate cut on Thursday could also serve to trigger additional capital flows into the Swiss currency which could also increase pressure for additional policy measures from the National Bank.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate* 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

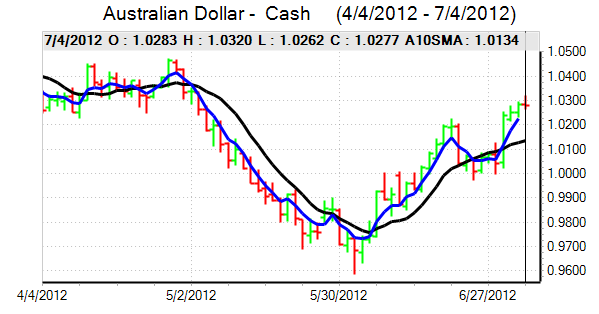

Australian dollar

The Australian dollar found support below 1.0250 against the US currency on Tuesday and pushed back to highs in the 1.0280 region during the New York session.

There was support from gains in commodity prices as gold prices advanced strongly during the day. There were still doubts surrounding the Asian economic outlook which dampened buying interest to some extent.

The latest retail sales data was stronger than expected with a 0.5% monthly increase which pushed the Australian dollar to highs above 1.03, but it struggled to sustain the gains.