EUR/USD

The Euro consolidated above 1.4120 during the European session on Friday, but was then subjected to heavy selling pressure and retreated to 2-week lows near 1.4025 during New York trading.

The EU Summit meeting confirmed that agreement on the interim Euro-zone rescue fund would be delayed until June. There was also an announcement that committed capital for the permanent facility due to start in 2013 would be cut to EUR16bn from EUR40bn previously.

The delays and capital reduction will increase market fears that political will for bailouts is fading. These pressures will be increased following the German election result as the governing Christian-Democrats lost their majority in the Baden-Wurttemberg state parliament for the first time in 58 years. Chancellor Merkel’s coalition will lose further support in the Upper House and there will be additional pressure to stop any further bailout concessions.

There will be further speculation that Portugal will soon formally apply for EU assistance and there will also be fresh contagion fears surrounding Spain.

The US economic data did not have a significant impact, but there were potentially important comments from Fed officials. Regional Fed President Plosser stated that the Fed should consider an early exit from the quantitative easing programme given the improvement in the economy. Fellow President Bullard also stated that the Fed should consider an early exit from the programme. Although not a voting member this year, Bullard played an important role in launching the second quantitative easing programme. The Euro remained on the defensive in Asia on Monday.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

The dollar found support on a brief dip to below 81 against the yen during Friday and advanced to highs around 81.40 late in the US session. There were further gains to a peak near 81.75 during Asian trading on Monday.

Yield considerations remained important and, although the US economic data was relatively lacklustre, there was a further rise in US Treasury yields with the spread over 2-year Japanese bonds rising to a six-week high around 55 basis points. The dollar also gained support from fresh speculation that the Federal Reserve would look to end the quantitative easing programme early.

Risk conditions were relatively benign which dampened defensive yen demand and there were further market expectations of longer-term yen declines on fundamentals grounds.

Sterling

Sterling was blocked around 1.6120 against the dollar during Friday and dipped sharply during New York trading with a test of support near 1.60 and the UK currency remained on the defensive during Monday as it also retreated to 2011 lows near 0.88 against the Euro.

As well as a weaker European currency trend, Sterling was unsettled by renewed doubts surrounding the economy. Following the Bank of England minutes and budget, there is reduced confidence that the central bank will be in a position to increase interest rates significantly given growth fears.

Structural considerations also remained important with renewed speculation that there could be a medium-term loss of the AAA credit rating due to debt fears. In this context, growth considerations will remain critical as the government will need solid private-sector growth to offset the negative impact of fiscal consolidation. MPC member Posen maintained his dovish stance in comments over the weekend.

The banking sector will also remain an important focus and the UK currency will be very vulnerable to further selling if fears surrounding liquidity and credit increase again.

Swiss franc

The dollar pushed to a high near 0.9150 against the franc in Europe on Friday and advanced further to a high above 0.92 in US trading as the Euro was able to resist selling pressure against the Swiss currency.

The franc has been unable to gain fresh support from renewed stresses surrounding Euro-zone debt and this suggests that there is already a substantial speculative long position in the Swiss currency.

Nevertheless, while confidence in the Euro-zone economies remains very fragile, there will continue to be a high degree of reluctance to sell the franc aggressively.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

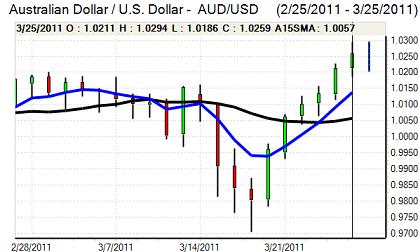

Australian dollar

The Australian dollar dipped briefly back below 1.02 against the US dollar during Friday, but then secured renewed gains and pushed to a 29-year high near 1.0290 during the New York session. There was support from steady risk appetite and firm commodity prices with the currency also continuing to gain support from a serious lack of attractive alternatives.

Momentum will continue to play an important near-term role, but there will also be the threat of rising volatility given the valuation stresses and uncertainty over domestic economic trends.