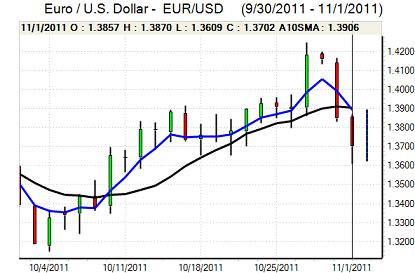

EUR/USD

The Euro remained under heavy selling pressure during the European session on Tuesday and dipped to below the 1.3660 support zone with lows near 1.36 before a technical recovery from over-sold conditions.

The announcement of a Greek referendum continued to have an important negative impact on sentiment, especially as it put last week’s Euro-zone Summit deal in severe jeopardy. There was strong criticism from other European governments over the decision. There were fears that the EFSF would find it much more difficult to attract funds and there was little chance of Chinese investment given the prevailing uncertainty.

Political tensions also remained extremely high in Greece following the announcement. There were reports of strong protests within the cabinet and one PASOK party member resigned. There were rumours that the referendum plan had collapsed, but Prime Minister Papandreou insisted that the plebiscite would go ahead as planned.

There was a fresh surge in Italian bond yields during the day as fears over the Euro-zone increased further and 10-year yields rose significantly above the 6.0% level. There will be very strong pressure on the ECB to take a decisive action at Thursday’s meeting with either a cut in interest rates or a much larger commitment to buying peripheral bond. This will be an extremely difficult meeting for new President Draghi and the Euro will tend to remain on the defensive.

The US PMI index for manufacturing dipped to 50.8 for October from 51.6 previously and there were mixed readings for sub-components as orders improved and inventories fell while there was a sharp decline in prices. The FOMC statement and Bernanke press conference will be important for sentiment. There were expectations that the Federal Reserve would signal its readiness to engage in further quantitative easing if required, but not take action at this meeting.

The Euro consolidated just above the 1.37 level in Asia on Wednesday as markets continued to fret over uncertainty.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate* 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

The dollar was generally confined to narrow ranges during Wednesday as attention switched back to the Euro-zone with the US currency finding support near the 78 level.

There was further speculation that the Bank of Japan would intervene again which deterred yen buying and there was also evidence that the central bank would not drain the excess cash from the banking system which would expand yen liquidity.

There was still an important lack of confidence in the other major economies which curbed any fundamental selling pressure on the yen with the US currency unable to break above the 78.50 area.

Sterling

Sterling was subjected to volatile trading during the European session on Tuesday as Euro-zone tensions were intensified by UK data releases. There was some relief surrounding the latest GDP data with a 0.5% increase for the third quarter following a 0.1% increase the previous quarter.

In contrast, the PMI manufacturing index fell sharply to 47.4 for October from 50.8 the previous month which was a two-year low for the index. The PMI data is forward looking and tended to have greater market impact with fears that the economy will be at risk of contracting in the fourth quarter.

The currency was also unsettled by fresh doubts surrounding the banking sector as European banking-sector prices came under heavy selling pressure.

There was support on dips towards 1.59 against the dollar and it pushed back to near 1.60. Sterling rose to a one-month high below 0.86 as the it attracted defensive inflows into the bond market as Euro-zone sentiment deteriorated again.

Swiss franc

The dollar continued to advance strongly against the franc during Tuesday and peaked just above the 0.8950 level before a retreat back to the 0.8850 area as wider US gains were the key drivers of sentiment. The Euro was unable to sustain a move back above the 1.22 level and retreated back towards 1.2150.

The Swiss PMI index weakened to 46.9 for October from 48.2, maintaining the sharp downturn seen during the previous few months. There will be further pressure on the National Bank to resist currency gains. Fresh tensions within the Euro-zone area will, however, also increase the risk that there will be a fresh attack on the minimum Euro level.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate* 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

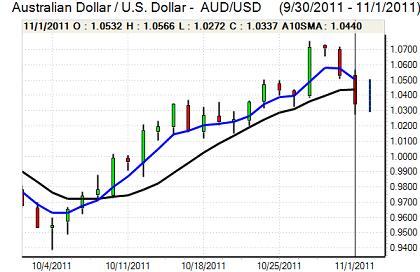

Australian dollar

The Australian dollar remained under pressure on Tuesday and there were several test of support in the 1.0280 region against the US currency as risk appetite deteriorated and there were fresh doubts surrounding the Asian economic outlook.

The latest economic data was disappointing with a decline in building permits of 13.6% for September following a revised 10.6% increase the previous month and there will be speculation over further interest rate cuts.

There was a tentative recovery in global bourses and risk appetite during the Asian session on Tuesday which pushed the Australian dollar back to above 1.0350 as volatility remained high.