EUR/USD

The Euro found support on dips towards the 1.27 area on Thursday and secured significant net gains against the dollar in choppy trading conditions. There were well-received bond auctions from Spain and Italy ahead of the ECB meeting which provided some underlying Euro support as peripheral yields fell sharply.

As expected, the ECB left interest rates on hold at 1.0% at the latest council meeting following rate cuts at the previous two meetings. Bank president Draghi stated that there was tentative evidence that the massive liquidity operations were having some success in easing credit conditions within the Euro area. Draghi also stated that there were some signs that economic activity was stabilising. There were no suggestions that the bank was looking to cut rates again in the very short term, but markets continued to expect further action.

There was further unease surrounding the Greek situation with continuing obstacles to a debt-restructuring deal. Two senior members of the German governing CDU party also stated that a Greek exit from the Euro area could be manageable. Inevitably, there is an important element of brinkmanship in negotiations, but underlying sentiment will be damaged if speculation intensifies.

In contrast to recent trends, the US economic data was weaker than expected and triggered fresh volatility in markets. The headline increase in retail sales was held to 0.1% while there was a core monthly decline of 0.2%. In addition, there was an increase in jobless claims to 399,000 in the latest week, in contrast to recent declines. The dollar gained some initial defensive support following the data releases, but then retreated as the Euro again benefitted from short covering.

The Euro pushed to highs near 1.2850 and maintained a firmer tone during the Asian session on Friday with an advance to the 1.2870 area.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate* 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

The dollar consolidated in the 76.0 area against the yen in Europe on Thursday and failed to gain any traction during the New York session. The weaker than expected US economic data had a negative impact and pushed the currency weaker as the dollar failed to gain any additional yield support.

Markets remained on high alert for comments from the Bank of Japan given the possibility of intervention to weaken the yen and the latest speculative positioning data will be watched very closely over the weekend.

Some easing of fear surrounding the global economy should lessen defensive yen demand to some extent and the Euro pulled away from recent lows, although uncertainty will remain very high.

Sterling

Sterling remained in a fragile condition against the dollar on Thursday with the latest economic data not providing any support. There was a 0.6% decline in industrial production for November as energy output fell and a small decline in manufacturing production. The data is liable to trigger some downward revision to fourth-quarter GDP estimates and the NIESR reported that there was a 0.1% economic expansion for the quarter.

The Bank of England left unchanged interest rates on hold at 0.50% at the latest policy meeting and rates have been left on hold for close to three years. The amount of quantitative easing was also left on hold at GBP275bn for the month. There was further speculation that the Bank of England could announce additional quantitative easing following the conclusion of the existing programme and this limited any Sterling support.

Wider Euro moves tended to dominate during the New York session and the UK currency retreated to lows near 0.8370 as it only edged slightly higher against the dollar.

Swiss franc

The dollar was unable to strengthen through the 0.9550 area against the franc on Thursday and was subjected to sharp selling during the New York session with lows in the 0.9420 area. There was a significant Euro move as it dipped to below 1.21 against the Swiss currency for the first time since the minimum Euro level was implemented.

There was no evidence of direct National Bank intervention and no additional rhetoric from the central bank. There was still speculation of covert action by the central bank given that it will not want the markets to sense weakness and attack the minimum 1.20 Euro level.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate* 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

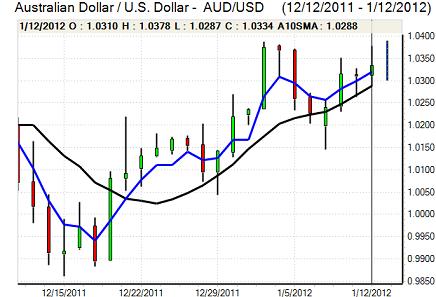

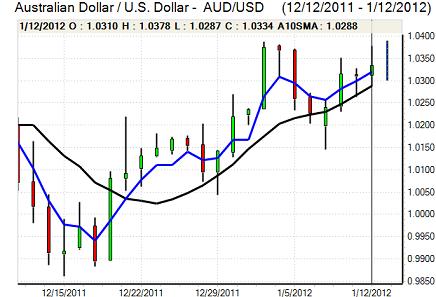

Australian dollar

The Australian dollar found support in the 1.0280 area against the US currency on Thursday and pushed sharply higher to a peak in the 1.0380 area before weakening sharply back to the 1.03 area following the weaker than expected US economic data. There was solid buying support on dips which allowed consolidation above 1.03 in Asia on Friday.

Underlying risk appetite remained firm which helped underpin the Australian currency. There were some concerns surrounding freight rates as there was another sharp decline according to the latest data which could be seen as an early warning of a sharp deterioration in global economic conditions.