CNBC is lying to you.

No, it’s worse than that, they are running what is effectively an infomercial for higher oil prices. In the course of watching CNBC for 8 hours yesterday, I counted well over a dozen times when CNBC commentators mentioned that the removal of 30Mb of oil from the Strategic Petroleum Reserve had no effect on the price of oil and, in fact, that prices were now higher than before Obama announced the oil would be released. Seems like a compelling case for tight oil supplies, right?

Well, maybe right if CNBC was not LYING. While oil has been PLEDGED to be released from the SPR – NONE has been released so far. That’s right – not 30 Million barrels as CNBC says, not 15M, not 5M – NONE, ZERO, not any… Is it possible that CNBC is simply grossly incompetent and just has their facts mixed up – every hour on the hour without one single guest saying anything other than the opposite of the truth? Perhaps – they are, in fact, extremely incompetent news people – but I think this goes a little beyond that. I’ll report and you can decide.

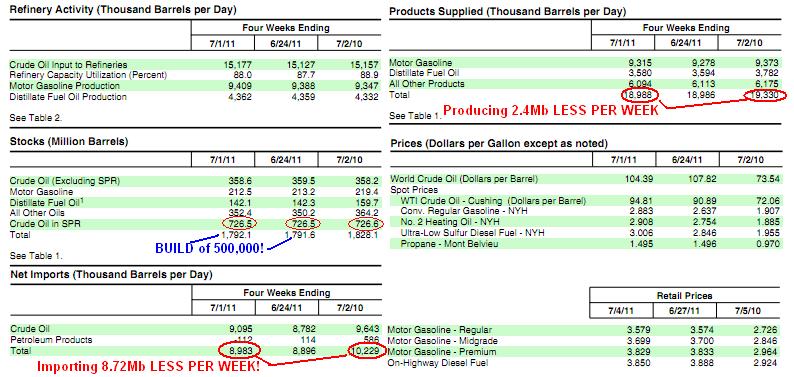

Here’s yesterday’s EIA report – which CNBC has, incidentally, been reporting as a draw even though, clearly there was a net BUILD of 500,000 barrels for the week. But forget that lie, that’s just the normal BS they throw at unsuspecting viewers each week in their endless quest to jack up the price of crude. Look at the 3 circles on the “Crude Oil in SPR.” It doesn’t take a degree in investigative journalism to determine that NO OIL has been removed from the SPR at all. This is the OPPOSITE of what CNBC is saying. That is, I believe, a lie.

Now, in the interest of giving CNBC the benefit of the doubt – in order to try to assume they are not engaged in a scam where they work with speculators to inflate the price of oil by making up stories, exaggerating or outright lying about critical energy reports or just generally maintaining a state of fear among their viewers as they sucker retail buyers into overpaying for what is, in fact, a readily available, easy and cheap to extract commodity – I will go deeper into the report, where it specifically looks at…