Our long nightmare (3 days) of uncertainty are over and now we are certain we may have some more QE some time in the future if certain things happen. Don’t you feel better? The markets sure do, with Europe and the US Futures completely reversing yesterday’s losses (see Dave Fry’s chart). I had said yesterday that, if we were not down 2% at the end of the Day, it would be a surprising show of strength and we never went lower than 1.5% on our indices and finished the day down less than 1% – proving once again that some of the people CAN be fooled all of the time. My comment yesterday was:

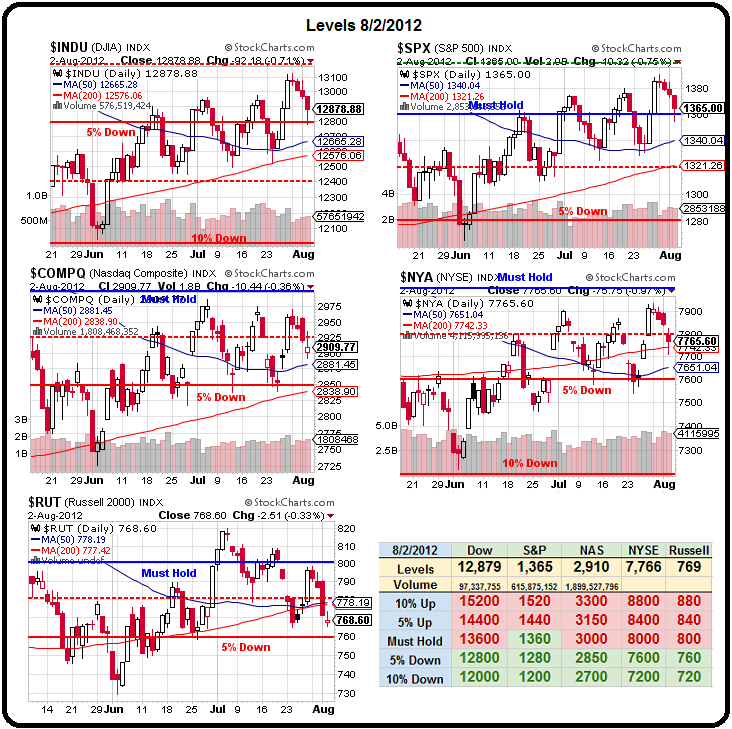

With a 200-point dump in the Dow Futures to 12,800 (12,850 in the regular index), we’ll be looking for a bounce to 12,840 as “weak” and 12,880 as “strong” but we’re not impressed at all until we’re back over 12,900 (50% retrace), which should be 12,950 in the regular session. Without doing all the math, that will be 1,370 on the S&P, 2,900 on the Nasdaq, 7,800 on the NYSE and 770 on the Russell. I don’t think we’ll be making those but you never know what those crazy Trade Bots will do once they turn the markets on.

Since the market IS controlled by robots (something Knight Capital did a good job of highlighting this week), it should come as no surprise to you that our indexes finished at Dow 12,878 (off by 2), S&P 1,365 (off by 5), Nasdaq 2,909 (9 over), NYSE 7,765 (35 off) and Russell 765 (down 5) – that’s a pretty good call for 8:30 am yesterday!

Since the market IS controlled by robots (something Knight Capital did a good job of highlighting this week), it should come as no surprise to you that our indexes finished at Dow 12,878 (off by 2), S&P 1,365 (off by 5), Nasdaq 2,909 (9 over), NYSE 7,765 (35 off) and Russell 765 (down 5) – that’s a pretty good call for 8:30 am yesterday!

As we discussed in Member Chat the other day, the moves made by our indexes between our 5% lines don’t matter – all we’re doing here is messing about within our ranges so far – wake us up when we break one way or another. In order for us to get more bullish, we’ll need to see those “Must Hold” levels turn green – and that’s Dow 13,600, Nasdaq 3,000, NYSE 8,000 and Russell 800 to join the S&P, which is over it’s 1,360 goal but has been alone there since May other than brief flirtation by the Russell over 800 in early July.