Watchlist: NOK TPX GILD WBS REG

Nothing really redeeming about today’s trades. It could of been a major disaster, I was over $100 in the red at one point with a wide stop on TPX and no stop in yet for ICE (its spiked a quarter right after I entered!). I did not panic and ended up break even though I doubled down, chased price, and traded ICE just because it’s a day-trading mover.

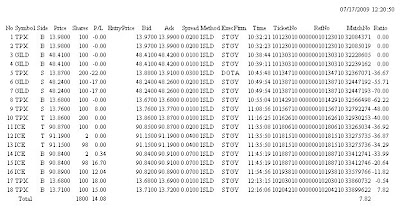

| Tick | # | Side | Gross | Fee | Net | Set-Up | Actual |

| ICE | 200 | S | 29.08 | -3.21 | 25.87 | Guess | Mixed |

| TPX | 500 | Flip x 3 | 19 | -6.83 | 12.17 | Flip | Top-Fade |

| GILD | 200 | L | -34 | -2.92 | -36.92 | ORH-BO | Top-Fade |

| $1.12 |

The only lesson really is to remember today is that the overall trading environment impacts the gapper set-ups I trade. Today seemed very choppy and range-bound and my watch list was very short with just a couple stocks gapping 2-3%. Days like this it seems to better to fade as breakouts beyond the range are harder. That was my impulse initially to short TPX and GILD at the top of their ranges, but they made pushes above ORH and I longed as they did – the last three days this would of worked wonders, but today my decisiveness ended up being buying at some morning tops and being stopped out for losses. Learning to differentiate between these types of conditions is an important thing to learn to help give the set-ups context each day.