Here is a great metaphor for the emptiness of the global recovery:

An entire city in China, tens of billions of dollars in construction, sits empty. They also built the World’s biggest shopping mall, also empty. As they say in the video, people can’t move in because there is no economy. Yet the building of the city of Ordos and the Utopia mall have allowed China to hit their 8% GDP growth target because it doesn’t matter whether you build something worthwhile – as long as you build SOMETHING, it’s going to count as part of your GDP. It’s ironic that this country still hasn’t bothered rebuilding New Orleans, which was once a healthy, vibrant city and we are letting Detroit die a little more every day when it’s ideally situated to attract (comparatively) wealthy Canadian tourists but China is willing to build entire cities from scratch.

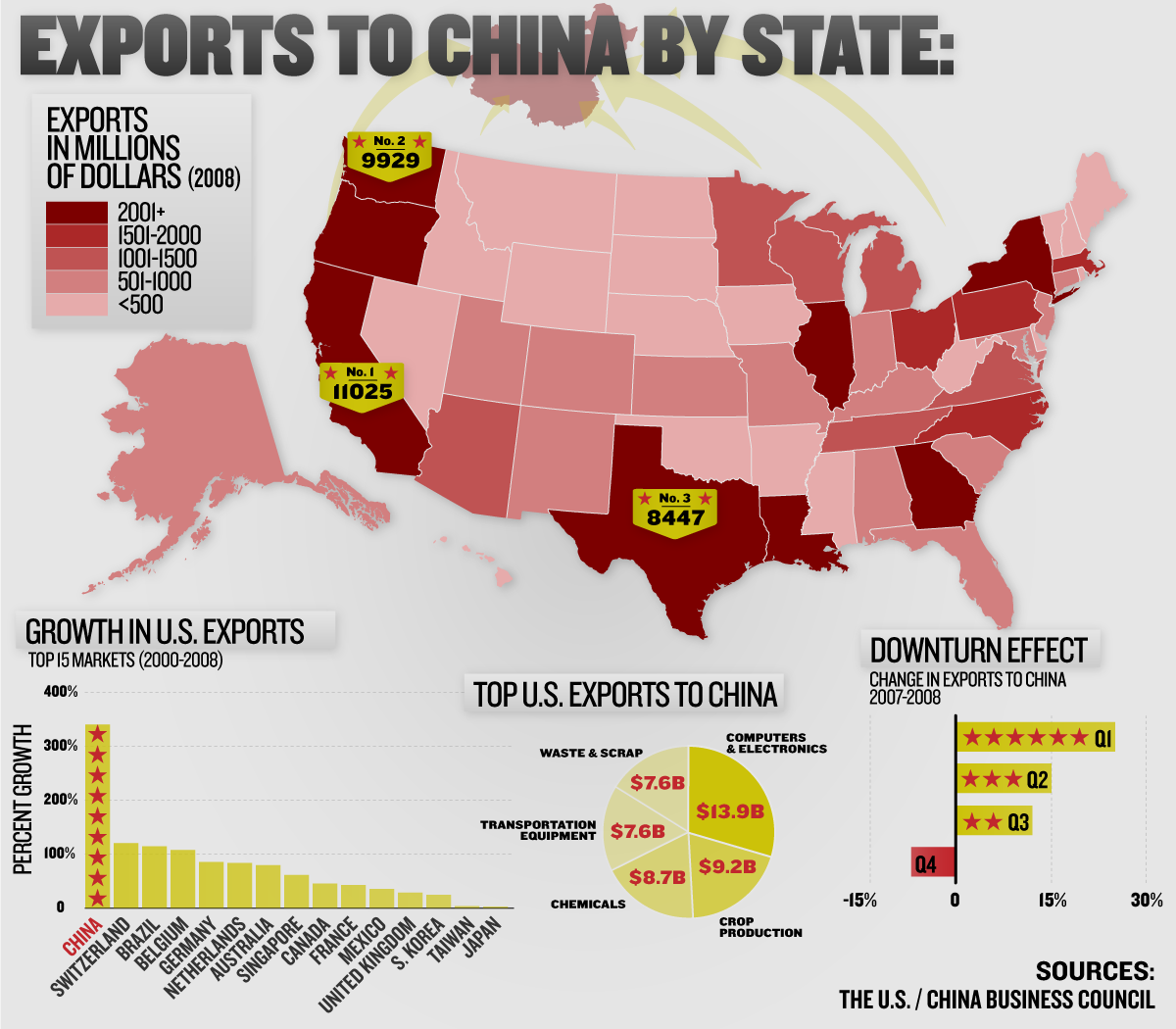

Ironically, Louisiana is one of 8 US states that export more than $2Bn worth of goods to China, who is, by far, our fastest growing trading partner. We get trade data later today and hopefully, at least one benefit of the week dollar will be to help boost our balance of trade but we’re a very, very long way away from balance and, as I pointed out last month, almost all of our gains are coming from lowered US consumption, not a real increase in exports.

Ironically, Louisiana is one of 8 US states that export more than $2Bn worth of goods to China, who is, by far, our fastest growing trading partner. We get trade data later today and hopefully, at least one benefit of the week dollar will be to help boost our balance of trade but we’re a very, very long way away from balance and, as I pointed out last month, almost all of our gains are coming from lowered US consumption, not a real increase in exports.

Speaking of lowered US consumption, just as we predicted, crude oil fell to the lowest in a month yesterday as the inventory report showed inventories in the U.S., the world’s biggest energy consumer, climbed DESPITE a drop in processing runs. Oil extended Wednesday’s 3%decline after an Energy Department report showed crude stockpiles rose a more-than- expected 1.76 million barrels last week. Refinery operating rates fell to 79.9 percent of capacity, the lowest in more than a year. Gasoline inventories rose 2.56 million barrels to 210.8 million, much more than a forecast drop of 350,000 barrels.

“The U.S. numbers were incredibly bearish, especially the gasoline build,” said Clarence Chu, an options trader at Hudson Capital Energy in Singapore. The decline in U.S. processing runs is in line with low rates in other developed countries. Japan’s refiners operated at 71 percent of capacity last week, an industry report said on Nov. 11. The two nations were responsible for about 29 percent of global demand last year, according to data from BP Plc. “Demand is just so anemic and the crack is so…