3.8 – 2009,

So, so – relative easy week behind and it´s time to go for weekend again. One of the top-10 markettimers in this world and one of my favorite one is Amanita from Austria. They came up again with very interesting work based for Benner´s Fibonacci table. Of cource this timeframe is not so much a feed for most nifty & rapid moving traders but for more real investors.

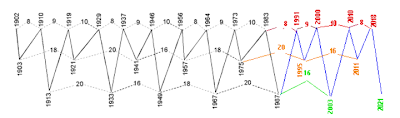

The coming bull market ideally lasts through to April-May 2010, then a short bear market starts until inflation is getting so high that everything (bonds excluded) begins to rise. The Benner-Fibonacci cycle aligns perfectly, since 1919 the highs and lows were all hits within a window of +/- some months, with just a single exception in 1964 (N=20):

1) 1995 low : low December 1994 (USA) – March 1995 (Europe)

2) 2000 high : inflation-adjusted high of the stock markets in 2000

3) 2003 low : bear market end in March 2003

4) 2010 high : This high is due from late 2009 through early 2011, most likely in Q2/2010 because by mid-year 2010 there is a host of tension angles in the sky – but it can’t be ruled out that the (inflation-adjusted) high is already set in September 2009. And it’s possible that this bull market not even offsets inflation in the US (= nominal bull market, real bearmarket), in Europe both outcomes are realistic (nominal bull market, real bear market or nominal & real bull market). Needless to say, the outcome heavily depends on inflation numbers, 50% $-inflation will most likely be beaten by the stock indices for months at most but hardly for years.

5) 2011 low : This low is due from late 2010 through early 2012, we might fall lower (in realterms) into Q2/2011.

6) 2018 high

7) 2021 low: the low of the 50-60 year Kondratieff wave, start of a boom for decades. My inflation-adjusted Elliott wave for the Western stock markets is that the year 2000 terminated the bull market which had been running since the 18th century and this is the 9th year of the correction of the large super-cycle. In nominal terms, the ABC correction off the 2000 high will likely be over by 2008-11 and the indices could rise to 100,000, 1 million or 1 billion points. Nevertheless, adjusted for inflation neither the S&P 500 nor the EuroStoxx 50 should ever take out their Y2K highs in our lifetime.

In the year following the 4-year cycle bear market, the Dow Jones has risen by 30-50% on average historically. That’s why I expect an advance into late 2009/ spring 2010 from the late 2008/ early 2009 bottom by at least 30-50%, it’s possible but not likely that the 2007 highs are attacked. The entire rally is only a product of inflation, don’t expect gains if inflation is deducted.

The Barnes index has plunged to an all-time low because the average yield of the S&P 500 companies was never higher compared to the short-term interest rates in the US (barely above 0%), so market risk is virtually non-existing according to this indicator. Nevertheless, gold has beaten the S&P 500 every year since 2001 (usually by a lot) and this pattern should continue to work the next years.

good sectors for the next years:

1) utilities : electricity, water (DJUSWU) and others

2) agriculture : is getting more important

3) industry, production : the public infrastructure investments help

4) defense , weapons : impending wars

Bad industries for the coming years are especially real estate/ REITs as well as the entire financial sector because the first 5 years after a bubble bursts (here: 2007) one should avoid this market. I warned of these sectors in 2007, as expected they have imploded the years. Please note that both sectors topped in early 2007 and that the typical pattern is that some 2.5 years after the top of a bubble an initial bottom is formed and a reaction for around one year follows. Therefore some time in 2009, ideally in the 3rd quarter, a rally in real estate & financials should start.

Good countries & regions for the next 5-10 years :

(1) Europe , especially Germany : At present the EU GDP is much larger than US GDP, after these two giants Japan and China ranking next, with a large gap.25 Europe has become the secret leader although this is not realized by most people. Many soft indicators confirm the change in sentiment, i.e. more and more US citizens who formerly emigrated to the US are returning to their home countries. 26 It’s always the leader who attracts most immigration. In late 2007 the Euro CFR27 was established, a clear sign for those who can read between the lines. Since the US empire is about to fall apart, a new leader for the fascist-communist new world order is needed, this can only be Europe because China is not under full control of the illuminati. The main goal of the Lisbon treaty is to prepare the EU for its global leader role, the military buildup required by the treaty is the core of the treaty (apart from the minor improvements in some areas to blind the brainwashed crowd).

(2) Many soft (social) and hard (economic) indicators are suggesting that the US is falling back to the level of a developing country. Investing means that future wealth is increased while consuming means to live now at the expense of the future (i.e. the ex-act opposite). Kurt Richebächer, formerly chief economist with Deutsche Bank, has analyzed this fundamental imbalance many times. US net investments have been collapsing for many years, if you take out the hedonic nonsense the numbers are even more worrisome. Being the world champion in consumer spending means nothing else than wealth being exported to Europe & Asia all the time, focused on the leadersin export: Germany, Japan & China.

(3) The demographic cycle is very positive for Japan, South Korea, China & Thailand the next decade but the problem with China & India is, of course, that in 2007 a bubble did burst and you are well-advised to stay away from a post-bubble market for at least 5 years (until 2012).

Bad countries & regions the next 5-10 years :

1) US : Around 2020 the US stock market should be 95-99% below the 2000 high in real terms.

2) Russia , Arabic countries : In Russia a bubble imploded in 2008, in some Arabic countries already earlier. The most bullish time for the oil price should be over by now, this is bad news for the oil-producing countries. Another drawback is that the risk of a major war involving Russia or the Middle East is rising considerably each year from 2009-13. Russia is also bad from a demographic perspective, although the Russian stock market today is very cheap with a price- arnings ratio of less than 5.

The year 2009 should be dominated by the bullish initial stage of the 4-year cycle. I proceed on the assumption that the 2nd quarter 2009 (especially April) is most bullish for stocks, fall 2009 (mid-September through mid-November) should be most bearish. The 1st quarter looks mixed. lows (+/- 2 weeks, signatures for lows are the angles of Jupiter to Saturn and Neptune for instance): important are February 2009 (ideal bottom of the year), late March 2009 & late October – November 2009. Other, presumably weaker lows are early June 2009 and August 2009. In his book “Time and Money” published years ago, Robert Gover mentions a possible panic date 2/5/09. Gover’s projected panic date 7/1/08 has turned out as correct. highs (+/- 2) weeks; signatures for highs are Jupiter-Uranus for instance): January 2009, early May 2009 (rather important), late June/ early July 2009, September 2009 (important, first candidate for the annual top), December 2009.

Sourche & Full Report;