EUR/USD

The Euro found support below 1.36 against the dollar on Friday and was generally stronger during the day as immediate fears surrounding Italy eased. The Italian Senate approved the government’s austerity packaged, paving the way for a lower house vote on Saturday, with markets expecting Prime Minister Berlusconi to formally resign over the weekend. There was a further decline in Italian bond yields which helped ease immediate fears.

Greece also installed an interim government under Papademos with elections tentatively scheduled for February. There was increase market optimism that the new technocrat governments would be able to settle market nerves and ease immediate pressures within the Euro area. There was increased confidence that the Greek government would maintain austerity measures as the Finance Minster stated that ensuring receipt the next the loan package would take top priority.

The latest US University of Michigan consumer index was stronger than expected with a rise to 64.2 for November from 60.9 previously which helped bolster risk appetite and also curbed defensive dollar demand.

Weekend events were broadly in line with expectations as a lower-house vote was followed by Berlusconi’s resignation and the nomination of Mario Monti to lead a new administration. Monti will need to name a new cabinet and then win confidence votes in both houses this week.

Relief that Euro-zone fears had eased helped push the Euro to highs just above the 1.38 level against the dollar before consolidation in the 1.3750 area as the dollar dipped to its lowest level since late October on a trade-weighted basis.

There were still important underlying stresses with reports that the German government had formulated plans to manage a Greek exit from the Euro area. Bundesbank head Weidmann also stated that the bank must not fund a Euro rescue. There was also still a fundamental lack of confidence surrounding the Euro area.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate* 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

The dollar was again unable to make any impression on the yen during Friday and dipped to lows near 77, the lowest level since the Bank of Japan intervention seen at the end of October. The US currency failed to gain any support from an increase in US yields following the consumer confidence data.

The latest Japanese GDP data was in line with expectations as there was a rebound of 1.5% for the third quarter following a revised 0.5% contraction previously.

Despite an easing of immediate fears surrounding the Euro-zone economy, there were still important fears surrounding the region and there was still evidence of capital repatriation which provided a firm base for the yen. There was also reduced speculation over aggressive Bank of Japan intervention, although complacency would clearly be dangerous even though the dollar failed to gain support on Monday.

Sterling

Sterling found support in the 1.59 area against the US dollar on Friday and then rallied strongly during the US session with a peak near 1.6070 as there were wider losses for the US currency. The UK currency was unable to make any impression on the Euro as it retreated to the 0.8580 area.

Underlying confidence in the UK economy remained weak with expectations of further near-term deterioration in conditions. There will also be expectations of a generally pessimistic Bank of England inflation report on Wednesday. There will be a particular focus on the banking sector, especially with 3-month Sterling Libor rates moving to above the 1.0% level.

Sterling trends were still dominated to an important extent by international developments and there was further defensive demand for UK bonds which also underpinned the UK currency as policy independence and sovereignty were seen as key virtues.

Swiss franc

The dollar was unable to make any move above 0.91 against the franc on Friday and weakened to lows just above 0.8950 before moving back to the 0.90 area. The Euro found support below 1.23 and pushed back to the 0.94 as Euro-zone fears eased slightly.

There has been a tentative resumption of the franc’s relationship with risk as the currency lost support when global risk conditions improved. Markets will remain very tentative in their treatment of the currency given the National Bank threat to prevent any renewed appreciation and clear trends may prove elusive.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate* 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

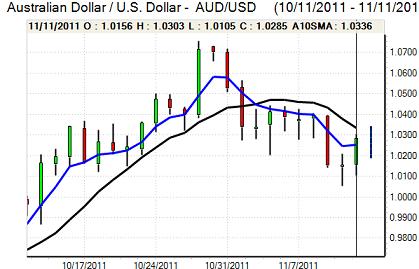

Australian dollar

The Australian dollar found support in the 1.01 area against the US currency and rallied firmly to a peak near 1.0350 as risk appetite improved. There were reduced fears surrounding the Euro-zone sovereign-debt crisis and there was also a general improvement in risk appetite which boosted demand for the Australian currency.

There were no significant domestic developments during the day as international trends tended to dominate. The Reserve Bank monetary policy minutes will be watched closely on Tuesday with the Australian currency vulnerable if there was talk of a series of rate cuts, although the minutes are likely to be more cautious.