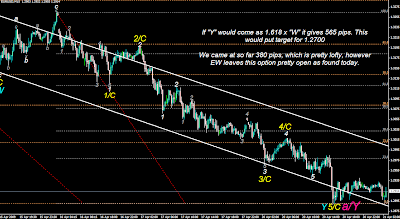

Finally found what I was looking for, well, this leaves pretty wide range open for my triangle part, not much help from EW books in this particular case. Basically ew says Y in here can be anything between the 330-1500 pips area….that´s funny, I used to idea allready all EW wave rulez are so tight, then potential Y wave size come as this large.

“Wave Y must be greater than 90% of Wave W by price, and Wave Y must be less than 5 times Wave W by price.”

But for corrective Z & X limits are strictly far more tight, we will propably stay inside of this falling log channels, for how deep I have no clue yet – but at least this 1.2900 set a daily support & bottom for it today, perhaps as final correction we need that Y with multiply of 1.618 of W (1.2700).

60 minute log channel is 250 pips range while 15 min log channel appears to be 100 pips range to consider we stay inside in here for longer.

Last time stocastic and RSI were this deep occured 29.3 and 16.2 in 4 hours datachart, so, I suppose oversold is right term to describe it. Perhaps it´s better to stay at oscillators driven zone with minute chart for a while (plus 1+5 minute patterns & ew´s). Eur-Usd is relative easy to read from oscillators when there´s also pattern available, in most cases if oscillators start to ramp up quickly but price is very lazy to take part of the action tells me there untrending corrective wave to be placed, same works for vica verca. This tick just really takes off, when it does and if it doesn´t participate for oscillators ramp something is allways very wrong, then there is pre-work progress going on for second plunge as there´s tight limit between the range oscillators can be driven.

I haven´t give an eye for stockmarket for a ages but it looks alike SPX also gave that diagonal to start rolling down. I called it somewhere earlier for bear wedge, but actually it´s not a bear wedge for my eyes at all after second look. All up from SPX 666 to 875 seems to look as A upwave for me. It´s just leading diagonal with no impulse waves (inside of diagonal) and there´s big different between the leading diagonal and ending diagonal, so I assume at so far it´s only correction and 750-770 should be enough for it, seems to come down with decent speed. This all give an idea it´s only corrective “B” wave. The key moment for SPX is not in here, it´s when it going to reach 750 or 770 area, which one determines also the more exactly the wave structure it works. If 750 would not hold either, then this party would be over for much longer term – but I have no interest at whatsoever for equities side now (until I start to see bullish wedges in there and massive big one´s).

I would bet 770 is enough for it, perhaps 1.2700 for this pair as well. All these retracements we leave behind of us tells a real lot for me about future also for me and are important details. For example I would say now when Eur-Usd 50% (1.3100) retracement with overlap didn´t offer much reversal, that chances for eternity bull market is cancelled in here because it terminates the possibility of new impule up wave. All what is left now is chance for C wave perhaps from next 78.6% (of cource C is impulse also – but after all it´s still only corrective wave). If SPX would go and retrace 750 as well, it´s would pretty much confirm from EW site that SPX all upwaves are only corrective as well, nor matter how far above 1000 it would lead, we still would be in bear market which basically going higher to drop again for new low.

This is not so big surprize when it happens between the currency pairs, after all – last upwave was also just corrective WXY, but I bet SPX will try to hold next 50% as 770 much stronger to leave some impulso options open for upside. If it goes and hit 750 as 61.8% to turn up from there – it would pretty much undersign long lasting bear signal nor matter how far it would ramp up.

Based for todays action this .618% didn´t mean absolutely nothing at all (which is very unusual) and it´s now more as resistance, still after 1.2900 bottom test, there´s none of the upside behaviour with Eur-Usd instead new bear triangle in 1 minute chart, but 1.2900 is now short term support, but likely won´t stay there for long.

We propably need to hit all pairs to key fib levels in here; USDJPY, EURJPY before there´s any more steady turn ahead.

Interesting detail how much far ahead all currency pairs bear patterns seems to be if compared for stock market, basically many weeks. Have to confess charts below looks a bit mad for me. After W wave changed for Y wave, price haven´t even touch upper falling channel line.