EUR/USD

The Euro initially hit resistance in the 1.3650 area against the US dollar and dipped to lows near 1.3575 before finding fresh support and re-testing resistance in the 1.3680 area.

Political and economic developments continued to have an important impact during the day.

ECB president Trichet stated that systemic risk to the Euro-zone had increased and was extremely cautious over the sovereign-debt situation. He also stated that collateral could not be accepted from defaulted states in a clear reference to Greece. Trichet also stated that the Euro was in no danger in an attempt to ease market tensions.

The Troika report on Greece stated that the 2011 budget targets would be missed and that there would also need to be further action to meet deficit targets from 2013 onwards. The troika recommended that the November loan payment should be made and this will now be debated within the Euro-member states with German officials warning that approval was not automatic.

There was further speculation that much larger private-sector Greek debt write-downs would be required, although this would also increase bad-debt positions within the Euro-zone banks. There were further concerns over the banking sector following Dexia’s collapse and a warning from Austria’s Erste Bank.

The Slovakian vote was in focus throughout the day and after a prolonged delay the government lost the vote on expanding EFSF powers. The vote has been tied to a confidence motion and another vote will now be required under a caretaker government. The Euro did fall following EFSF rejection, although the impact was measured given expectations that it would still pass eventually. Tensions will be much higher if approval looks to be in serious doubt.

The US developments were of secondary importance during the day and the Euro briefly retreated back to below 1.36 following the Slovak vote with consolidation in Asia on Wednesday as some defensive dollar support returned.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate* 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

Dollar-yen ranges were again very narrow during Tuesday with neither currency able to secure a breakout and both also continued to move in line with trends in risk appetite.

Markets generally wanted to take a more optimistic tone on risk, but the yen was still resilient given severe underlying fears surrounding the banking sector.

The US Senate passed the Chinese Currency Manipulation Bill which sparked high volatility in Chinese markets as the central bank intervened to support both the yuan and the stockmarket. There is likely to be some short-term yen benefit as unease over the Asian outlook increases, although the dollar remained locked in tiny ranges.

Sterling

Sterling was unable to regain the 1.5680 level against the dollar during Tuesday and retreated to lows below 1.56 despite a generally fragile US performance. This divergence was reflected in a Sterling decline to beyond 0.8750 against the Euro.

The DCLG reported a 1.3% decline in house prices in the year to August, maintaining a run of generally very cautious data. Industrial output edged higher for August, but the positive impact was offset by a decline in manufacturing. The NIESR estimated that GDP growth was 0.5% for the third quarter of 2011. There will be some relief that the economy appears to have made some headway, but underlying sentiment is likely to be extremely fragile, especially given the UK debt burden.

There will be further concerns that weak confidence will undermine spending, especially with the banks continuing to take a very cautious stance over lending and sentiment will deteriorate further if there is a poor set of employment data.

Swiss franc

The dollar found support on dips towards the 0.90 level against the franc on Tuesday and briefly rallied back to above 0.91 in choppy trading conditions. The Euro also found support on dips towards 1.23 while resistance was tough to break down above 1.24.

There were hopes that Euro-zone leaders were moving towards strengthening the banking sector which tended to lessen support for the franc, although moves are still tending to be dominated by expectations surrounding National Bank policies as speculation over further action stifled any franc buying interest.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate* 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

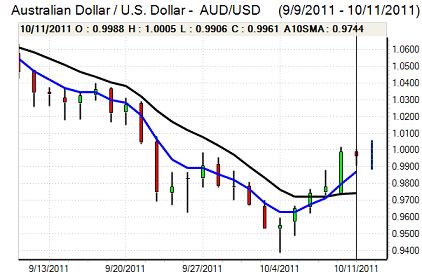

Australian dollar

The Australian dollar attempted to challenge parity against the US currency during Tuesday, but was unable to break through and dipped back towards 0.9950.

Initially, there was some evidence of greater optimism surrounding the Chinese economy which also provided some degree of Australian dollar support as wider selling pressure on commodities eased. This position was reversed in local trading on Wednesday as Senate passage of the Currency Bill sparked fresh declines in Asian currencies and also undermined the Australian dollar.

There was caution ahead of the latest employment data on Thursday with a slightly higher than expected home-loans figure providing some currency support.