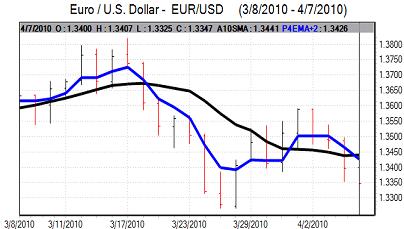

EUR/USD

The Euro was unable to sustain a recovery above 1.34 against the dollar on Wednesday as debt fears surrounding the Euro-zone remained a key influence.

There were further concerns over the Greek situation during the day as yield spreads over German bunds continued to widen. There were increased fears that Greece would face a vicious circle with rising debt costs making it even more difficult to meet deficit targets. This, in turn, would also further undermine sentiment and maintain Euro selling pressure.

There was further speculation that Greece would eventually be forced to default which tended to keep the Euro on the defensive. Fourth-quarter Euro-zone GDP was revised to show no change from 0.1% previously which also hampered sentiment.

The ECB will hold its latest council meeting on Thursday and an interest rate change from 1.0% looks very unlikely. Markets will remain on high alert over comments on monetary policy and the Greek situation from ECB President Trichet.

There were no significant US data releases during the day with the US currency still hampered to some extent by reduced expectations of higher interest rates following the Fed minutes.

The Euro dipped to lows around 1.3325 and a rally attempt later in the US session again stalled relatively quickly.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

The Bank of Japan held interest rates at 0.10% following the latest monetary policy meeting which was in line with market expectations. The bank also expressed confidence that the economy was picking up in its latest report.

Risk appetite remained generally robust in Asian trading on Wednesday which curbed defensive demand for the yen as there was optimism surrounding the Asian economy. The dollar was still blocked in the 94.25 region against the yen.

The yen was able to resist further selling pressure during the day with some speculation over a stronger Chinese currency having some impact in supporting the yen. Falling US equity markets also had a negative impact on risk appetite with the dollar weakening to lows near 93.30 in US trading.

Sterling

The UK currency was blocked close to 1.5280 against the US currency in early Europe on Wednesday. The services-sector PMI index weakened to 56.5 for March from 58.4 the previous month and, although the index was still at healthy levels in historic terms, there were fears over a slowdown in the economy. In contrast, the OECD was relatively optimistic in its latest report.

There was also a weaker UK gilt auction which tended to undermine slightly and Sterling weakened to lows below 1.5150 following the data. Sterling again found support at lower levels and recovered back to the 1.5270 area later in the US session.

Sterling maintained a robust tone against the Euro and it pushed to a six-week high which also allowed the trade-weighted index to push to a six-week high.

The Bank of England will announce its interest rate decision on Thursday and it will be very reluctant to change interest rates while the general election campaign is underway.

Swiss franc

The dollar found support around 1.0680 against the franc on Wednesday and pushed to a high around 1.0745 before stalling. The Euro held above 1.43 against the franc on further speculation that the National Bank would block gains, but the Euro was unable to make much headway.

Retail sales rose 3.1% in the year to February which should maintain cautious optimism towards the economy. Financing concerns within the Euro-zone are still likely to be the dominant influence and the Euro will continue to find it very difficult to make headway.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

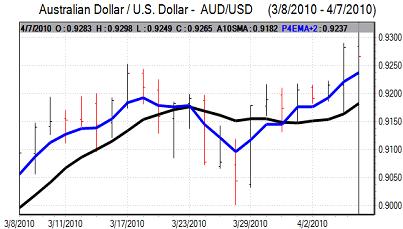

Australian dollar

Underlying confidence in the Australian dollar remained generally firm on Wednesday, but there were fresh concerns over the risk of further Chinese monetary tightening during the second quarter which will tend to restrain buying support for the currency.

There was still a firm tone for commodity prices and, after a decline to 0.9250, there was a rebound back to the 0.93 area during the US session. There was some renewed selling late in New York as equity markets were subjected to selling pressure.