EUR/USD

The Euro consolidated in the 1.40 area against the dollar during the European morning on Monday with evidence of central bank buying support on dips, but was subjected to renewed selling pressure during the New York session.

There were further concerns surrounding Italy as bond yields continued to move higher as benchmark 10-year yields rose to near 6.10% despite further ECB buying. There were further doubts whether austerity measures would be enacted by Prime Minister Berlusconi’s government, especially as it remains in a very vulnerable position.

In this context, there will be further pressure on the ECB at this week’s meeting. There will be increased demands for the central bank to cut interest rates and there will also be calls for the bank to take a more aggressive stance in buying Italian bonds. This pressure will put incoming President Draghi in a very difficult position and underlying Euro confidence will tend to weaken.

There was a further serious setback for the Euro as Greek Prime Minister Papandreou called for a referendum to decide whether the EU relief package should be accepted. There were doubts whether a referendum would be allowed under Greek law and there was a renewed surge in uncertainty. Given the degree of popular opposition to austerity measures, there will be expectations that a referendum vote would fail. This will also create huge uncertainty over the planned write-downs for Greek debt which will further undermine market confidence both in the deal and the Euro.

The US economic data did not have a major impact as the Chicago PMI index weakened to 58.4 for October from 60.4 previously, although the employment component rose to a six-month high. There will be uncertainty surrounding the Federal Reserve FOMC meeting which starts on Tuesday with speculation that there will be further quantitative easing measures.

The Euro was subjected to heavy selling pressure and weakened to lows near 1.38 in Asia on Tuesday as a weaker than expected Chinese PMI report also undermined risk appetite.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate* 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

The dollar peaked in the 79.50 area against the yen during Monday as dipped back to lows below 78 as the Bank of Japan eased back from intervention.

The evidence suggests that there was substantial intervention by the central bank, potentially of at least JPY10trn, exceeding the amount seen in early August. There will be fears over further near-term intervention which will limit the scope for speculative yen buying.

The yen will still gain underlying protection from a lack of confidence in the US and Euro-zone economies and there will be further currency support if there is a sustained deterioration in risk appetite. The dollar edged back above the 78 level in Asia on Tuesday as ranges narrowed.

Sterling

Sterling dipped sharply to lows around 1.5970 against the dollar on Monday, but then found strong buying support and pushed to a peak above 1.6150 against the US currency. There were very substantial moves on the crosses as the Euro weakened to lows below 0.86 before finding some support. Sterling continued to gain some important support from a lack of confidence in the Euro-zone with a further flow of funds into UK bonds.

The UK data was mixed with consumer lending and mortgage approvals remaining generally subdued. There was another decline in money supply for the month and persistent weakness in monetary growth is certainly a very important reason why the Bank of England decided to expand its quantitative easing programme.

The latest GDP data and PMI reports will be watched closely and there is likely to be a further surge in volatility. A rebound in GDP growth would provide some support for Sterling, but there will still be fears over the fourth-quarter outlook, especially if there is a slide in the PMI index.

Sterling dipped back to the 1.6050 area on Tuesday as the US currency secured wider support on risk aversion.

Swiss franc

The dollar found support in the 0.8675 area against the franc on Monday and rallied further to a peak above 0.8790 during the Asian trading on Tuesday. The Euro was unable to make any impression on the Swiss currency and weakened to lows below 1.2150. The franc may gain some additional defensive support if markets believe that yen gains will be blocked.

The National Bank will become extremely anxious if the Euro weakens back towards the 1.20 level as this would encourage hedge-fund speculation against the minimum level and could put intense pressure on the central bank.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate* 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

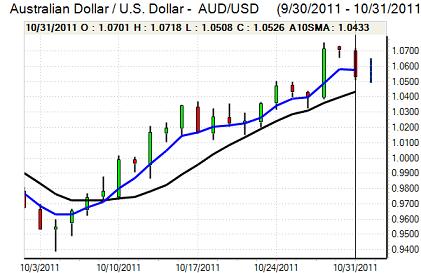

Australian dollar

The Australian dollar rallied back to the 1.06 area against the US dollar on Monday, but it was unable to hold the gains and retreated to the 1.0530 area during New York trading as the US currency secured wider gains.

The Reserve Bank of Australia cut interest rates by 0.25% to 4.50% following the latest policy meeting. The bank cited an improvement in the inflation outlook for the reduction and increased doubts surrounding the global economy. A weaker than expected Chinese PMI report, allied with wider Euro-zone pressures, added to selling pressure on the Australian dollar and it retreated to lows below the 1.0450 level against the US currency.