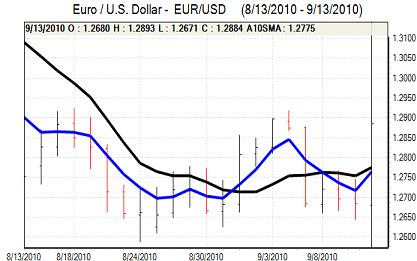

EUR/USD

The Euro pushed higher in Asian trading on Monday as risk appetite remained firmer and there were no surprises from the new Basel bank capital regulations. There was longer than expected for the new capital levels to be reached while there were concessions for the German savings banks which helped underpin Euro sentiment.

There was initial Euro resistance above the 1.28 level, but the currency secured a further advance later in the European session with some support from a raising of the European Commission’s Euro-zone growth forecasts.

There was further demand for commodity currencies during the day as risk appetite remained firmer and the was some evidence of the Euro being used as a funding currency. There were still underlying fears surrounding the Euro-zone and option prices indicated that demand for Euro puts was still at a very high level which suggests that underlying confidence in the currency remains very weak.

Demand for the dollar also remained generally limited with little incentive for buying the currency given the improved risk conditions and lack of confidence in the US fundamentals. There were no major US data releases to guide the markets and the Euro was able to consolidate above 1.2850 later in the New York session. The dollar could gain some support from a stronger than expected retail sales report on Tuesday.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

Domestically, the Democratic Party leadership campaign will be watched closely during the forthcoming week with a vote due to be taken on Tuesday. There will be further speculation that challenger Ozawa will be more willing to consider intervention if he wins the leadership, especially as he is potentially less concerned over upsetting other G7 members over the currency issue.

Demand for the yen was slightly weaker on Monday as risk appetite was generally firmer, but the dollar failed to benefit as there was reduced demand for both currencies during the Asian session.

The US currency was subjected to renewed selling pressure later in the US session as it re-tested support levels close to 83.50. There was support near this level, but the dollar secured only a limited rebound.

Sterling

Sterling rallied to the 1.54 area against the dollar in early Europe on Monday as the dollar was generally weaker as risk appetite remained firmer. As the dollar dipped weaker, there were further gains to a peak near 1.5490 with some support also seen from an improvement in international risk appetite.

As has been the case in recent sessions, the UK currency was unable to sustain the gains and weakened back to the 1.54 region as firm demand for the Euro pushed Sterling to lows beyond 0.8350. Underlying confidence in the domestic economy remained fragile amid expectations that there would be a renewed slowdown in demand.

There were further warning over strike action at the Trades Union Congress conference and the prospect of extensive industrial action had some negative impact on Sterling.

A stronger than expected inflation report on Tuesday could provide initial Sterling support, but any gains could reverse quickly on doubts whether the Bank of England would be in a position to react with a tighter monetary policy.

Swiss franc

Following the rapid moves seen on Friday, there was reduced volatility in the franc during Monday. The Euro hit resistance above 1.30 against the franc and consolidated above 1.2950. The dollar remained under pressure with lows below 1.0080.

There was relief over the Basel proposals which lessened defensive demand for the franc slightly. The impact was limited, especially as there were still important tensions surrounding the Euro-zone with a lack of confidence in the medium-term outlook.

There will be caution surrounding the National Bank policy meeting this Thursday with unease over the potential for further currency volatility over the next few sessions.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Australian dollar

The Australian dollar maintained a robust tone during the Asian trading session on Monday and it pushed to a high above the 0.9350 level against the US currency. There was profit taking during the European session, but underlying confidence in the currency remained firm with solid buying support on dips as investors looked to buy into higher-yield instruments.

There was further optimism surrounding regional growth prospects following the Chinese economic data and this continued to provide some underlying support to the Australian currency as commodity prices remained firm. Wider risk appetite was also solid which helped underpin the Australian dollar.